External Commercial Borrowings (ECBs) is a significant component of foreign investment in today’s globalised world. This holds particular significance for growth and development in a developing country like India. This article aims to study in detail External Commercial Borrowings (ECBs), its meaning, regulation, benefits, associated issues, and other related concepts.

What is External Commercial Borrowing (ECB)?

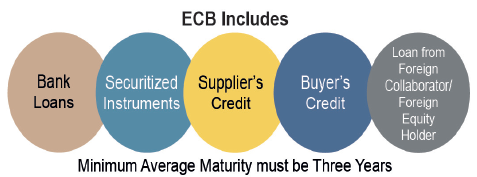

- External Commercial Borrowings refers to a loan availed by an Indian entity from non-resident lenders with a minimum average maturity.

- It includes commercial bank loans, suppliers’ credit, buyers’ credit, securitized instruments such as floating rate notes and fixed rate bonds, etc., credit from official export credit agencies, and commercial borrowings from the private sector window of multilateral financial Institutions such as Asian Development Bank (ADB), International Finance Corporation, AFIC, CDC, etc.

- In India, they are extensively used to enable Indian corporations and public sector undertakings (PSUs) to access foreign capital.

Restrictions on External Commercial Borrowings

The capital under External Commercial Borrowings can be availed with the following conditions:

- They cannot be used for investment in stock markets or speculation in real estate sector.

- The minimum average maturity of such loans is three years.

- They can be raised in Indian Rupees as well as any convertible currency.

- India’s External Commercial Borrowing Policy (ECB Policy) seeks to keep an annual cap or ceiling on access to ECB (individual limits as well as overall limit), consistent with prudent debt management.

Objectives of External Commercial Borrowings

- The government allows such borrowings as an additional financing option for both expanding existing capacities and making new investments.

- The ECB policy of the Government seeks to emphasize the priority of investing in the core sectors and infrastructures such as Roads, Railways, Power, Telecom, Urban infrastructure, etc.

Regulation of ECBs in India

- The Department of Economic Affairs (DEA), Ministry of Finance, Government of India, in coordination with the Reserve Bank of India (RBI), monitors and regulates such borrowings.

- External Commercial Borrowings in India can be accessed via two routes viz. Automatic Route and Approval Route.

Benefits of ECBs

- Interest rates of ECBs are lower as compared to domestic funds, hence they provide a cheaper source of funding.

- They are denominated in foreign currencies, allowing corporations to obtain the foreign currency needed to cover costs such as importing machinery and paying suppliers in other countries.

- They provide an opportunity to borrow large volume of funds (like funds for infrastructure projects), and these funds are available for a relatively long term.

- Corporates can raise ECBs from internationally recognised sources such as international capital markets, banks, export credit agencies, etc.

Issues with External Commercial Borrowings

- The External commercial borrowings increase the external debt of the country. That is why it has to be matched with the growth of foreign exchange reserves in the country so as to maintain solvency.

- Availability of funds at a cheaper rate under such borrowings may bring a lax attitude among the Indian companies, and result in excessive borrowing.

- This may eventually result in higher debt on the balance sheet, and adversely affect many financial ratios.

- Higher debt on the company’s balance sheet may also result in a possible downgrade by rating agencies, which might eventually increase the cost of debt.

- Companies may have to incur hedging costs or assume exchange rate risk, which if goes against, may end up negative for the borrowers.

- Also increase in such borrowings is accompanied by an increase in currency risk as there will be depreciation in the rupee, which will lead to an increased burden on the borrower as the value of the rupee depreciates.

- Thus, increased dependence on such borrowings is less favourable and if not controlled, there can be huge debt causing problems for the economy.

Conclusion

External Commercial Borrowings are a vital financial instrument that enables Indian companies to access international capital for growth and development. While it offers several benefits, it also comes with challenges. By understanding its significance and managing its potential downsides, countries can leverage it to achieve sustainable economic growth and development.

RBI’s New Relaxed Framework for ECBs

- The borrowing limit under the automatic route has been kept unchanged at $750 million per financial year, but the sector-wise limits have been replaced.

- The definition of beneficiaries eligible for External Commercial Borrowings has been expanded to include all entities that can receive Foreign Direct Investments (FDIs).

- Entities now eligible include: units in special economic zones, microlenders, not-for-profit companies, port trusts, non-government organisations, and registered societies/trusts/cooperatives.

- The Small Industries Development Bank of India (SIDBI) and Export-Import Bank (EXIM) have been allowed to borrow from the recognised lenders overseas.

- The earlier 4-tier structure has been replaced by 2 specific channels: dollar-denominated and rupee-denominated.

- The minimum average maturity period has been fixed at three years for all ECBs, regardless of the borrowing amount, except for borrowers specifically permitted to borrow for a shorter period, such as manufacturing companies.

- Earlier, the minimum average maturity period was 5 years.

- Further, if it is raised from a foreign equity holder and utilised for working capital, general corporate purposes, or repayment of rupee loans, the maturity period will be 5 years.