The Finance Commission of India (FCI), a constitutional body, stands as a cornerstone of the country’s fiscal federalism. Through a balanced and fair distribution of financial resources between the Center and the States, it ensures equitable growth across the country. This article aims to study in detail the Finance Commission of India (FCI), including its constitutional mandate, composition, powers, functions, challenges faced by it, and other related aspects.

About the Finance Commission of India (FCI)

- The Finance Commission in India is a quasi-judicial body constituted by the President of India under the provisions of the Constitution of India.

- Since it is established directly under the provisions of the Constitution, it is a Constitutional Body.

- It is not a permanent body and the President of India constitutes the Finance Commission every fifth year or at such earlier times as he/she considers necessary.

- The primary function of the Finance Commission revolves around making recommendations on the distribution of financial resources between the Union Government and the State Governments.

Constitutional Provisions Related to the Finance Commission of India (FCI)

Article 280 and Article 281 of the Constitution of India deal with the provisions related to the Finance Commission of India (FCI).

| Article No. | Subject Matter |

|---|---|

| Article 280 | Finance Commission |

| Article 281 | Recommendations of the Finance Commission |

Composition of Finance Commission of India (FCI)

- The Finance Commission consists of a Chairman and four other members to be appointed by the President.

- The Chairman and other members of the Commission hold office for such period as specified by the President in his/her order.

- The Chairman and other members of the Commission are eligible for reappointment.

Qualifications of Members of Finance Commission (FC)

- The Constitution authorizes the Parliament to determine the qualifications of members of the Commission.

- Accordingly, the Parliament has enacted the Finance Commission Act, of 1951 which specifies the qualifications of the members of the Finance Commission as follows:

- The Chairman should be a person having experience in Public Affairs.

- The four other members should be selected from amongst the following:

- a judge of the High Court or one qualified to be appointed as one.

- a person who has specialized knowledge of finance and accounts of the government.

- a person who has wide experience in financial matters and administration.

- a person who has special knowledge of Economics.

Functions of Finance Commission (FC)

- The Finance Commission of India is required to make recommendations to the President of India on the following matters:

- The distribution of the net proceeds of taxes to be shared between the Centre and the States, and the allocation between the States of the respective shares of such proceeds.

- The principles that should govern the grants-in-aid to the States by the Centre, i.e., out of the Consolidated Fund of India.

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and the Municipalities in the State on the basis of the recommendations made by the State Finance Commission.

- Any other matter referred to it by the President in the interests of sound finance.

Report of Finance Commission (FC)

- The Finance Commission submits its report to the President of India.

- The President of India lays the report of the Finance Commission before both Houses of Parliament along with an explanatory memorandum as to the action taken on its recommendations.

Aspects of Recommendations of Finance Commission

The Finance Commission recommendations cover various aspects of fiscal federalism as described below:

- Vertical Devolution – It refers to the share of States in the divisible pool of Central taxes.

- This aspect plays a crucial role in promoting fiscal autonomy among States.

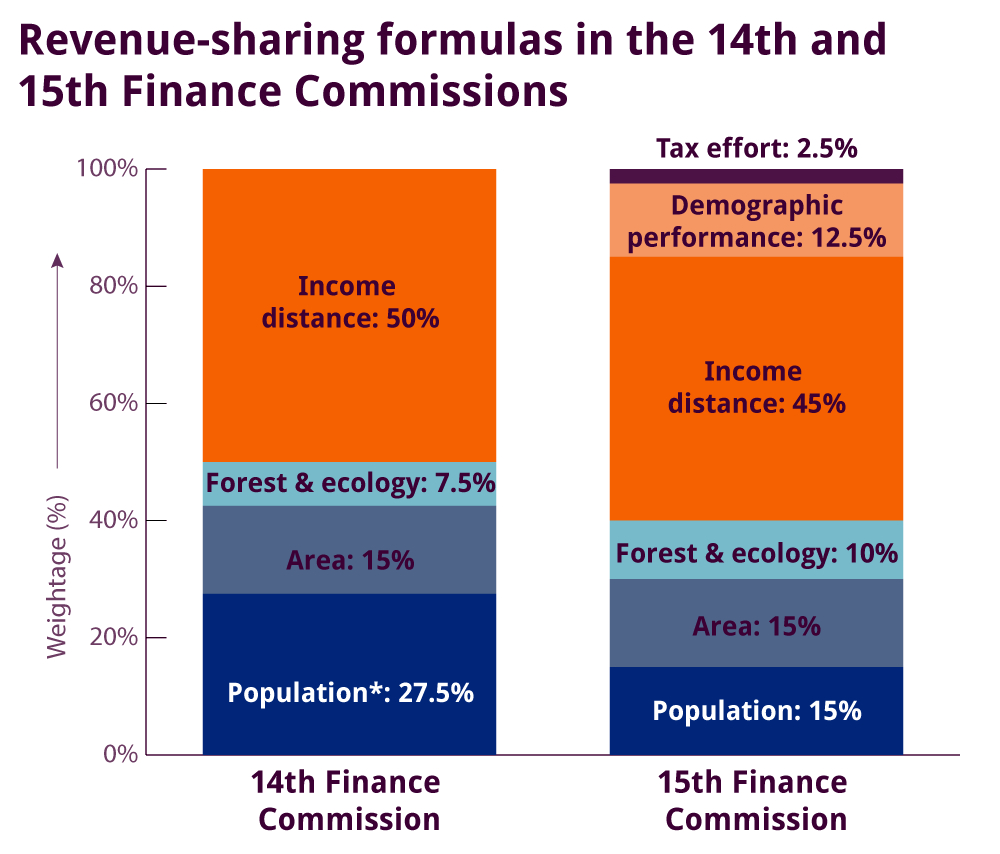

- Horizontal Distribution – This refers to the allocation of resources among States.

- The Finance Commission makes this recommendation based on a formula so as to ensure equitable distribution of funds and foster balanced development across the regions.

- Grants-in-aid – It refers to the additional transfers to specific states or sectors that are in need of assistance or reform. For example, grants for improving the justice delivery system or enhancing the statistical infrastructure in the States.

- This aspect of Finance Commission recommendations aims to promote inclusive growth and address regional disparities within the country.

Nature of Recommendations of Finance Commission (FC)

- The recommendations made by the Finance Commission are only advisory in nature.

- Hence, they are not binding on the Government.

- It is up to the Union Government whether to implement or not to implement its recommendations on granting money to the States.

Role of Finance Commission in India

The Finance Commission of India plays a crucial role in the country’s fiscal architecture. Prominent roles played by the Commission can be seen as follows:

- Equitable Distribution of Resources: While recommending the manner of distribution of revenues between the Center and states and among the states themselves, the Commission takes into account factors such as population, area, economic backwardness, etc. This ensures that the resources of the country are allocated in an equitable manner.

- Promotes Social Welfare: The Commission recommends the principles governing the grants-in-aid to states that may not generate adequate revenue themselves for essential services like health, education, and infrastructure. This reduces fiscal imbalances and promotes social welfare.

- Empowered State Governments: Increased financial resources provide states with financial autonomy. This, in turn, means that state governments are empowered.

- Strengthens Local Self: Government: It also suggests measures to augment the Consolidated Funds of the states to supplement the resources of the Panchayats and Municipalities. This ensures that local bodies have adequate resources to perform their constitutionally mandated functions.

- Strengthened Federalism: The commission fosters cooperation and dialogue between the central and state governments on financial matters, promoting a healthy federal structure.

- Fiscal Consolidation and Discipline: By recommending measures for maintaining a stable and sustainable fiscal environment, it promotes fiscal stability and sound financial management both at the central and state levels. This, in turn, aids the sound economic growth of the country.

- Incentivizing Reforms: By linking financial allocations to reform milestones, the Commission encourages states to adopt best practices that lead to more efficient governance and improved service delivery.

- Addressing Contemporary Challenges: The Commission also aids in addressing contemporary fiscal challenges and the changing dynamics of the Indian Economy. For example, considering the impact of new financial arrangements and policies, such as the introduction of the Goods and Services Tax (GST).

Finance Commission and Fiscal Federalism

What is Fiscal Federalism?

Fiscal Federalism refers to the division of fiscal responsibilities and financial resources between different levels of government within a federal system. It deals with the distribution of revenue-raising powers, expenditure responsibilities, and fiscal transfers between the Central Government and subnational entities, such as States or Provinces.

Role of the Finance Commission in Promoting Fiscal Federalism

The Constitution envisages the Finance Commission as the balancing wheel of fiscal federalism in India. Accordingly, the role Role of Finance Commission in India is to facilitate Fiscal Federalism in India as can be seen as follows:

- It bridges the vertical financial imbalances between the Centre and the States.

- By allocating sufficient resources to them, it promotes the fiscal autonomy and efficiency of the States.

- It bridges inequality among the States by giving more to the backward States.

- The commission’s work necessitates consultation with both the central and state governments. This fosters a spirit of cooperative federalism, where all levels of government work together for shared goals.

Challenges and Limitations of the Finance Commission (FC)

- Data Gaps and Quality Issues – Commission depend on official data sources to evaluate the fiscal condition and performance of both the Union and the States. However, these data are mostly incomplete, inconsistent, or outdated.

- Political Factors – Commissions must reconcile the conflicting interests and demands from the diverse stakeholders, including the Union Government, State Governments, Local Bodies, Civil Society Groups, etc.

- Additionally, they must consider the changing political and economic scenario in both the country and the world.

- Resource -Responsibilities Imbalance – One of the major limitations of the Commission is that its resources are limited while its responsibilities are virtually unlimited.

- Overlap of Domains – There exists an intersection between the domains of the Commission and the Goods and Services Tax (GST) Council. Decisions made by the GST Council affect the flow of tax revenue to the States and the size of the Central tax revenue pool, which is subsequently distributed among the Central and State Governments as per the recommendations of the Commission.

- Demands for Centralization of Expenditure – India has a federal system of governance wherein both the Center and the states have autonomy in their assigned jurisdictions. However, of late, there have been demands for greater centralization of expenditure assignments. Thus, the Commission has to grapple to strike a balance between the two.

- Limited Control over Third-tier Government – The Commission has limited control over the third-tier government and makes its recommendations w.r.t. the third-tier government only on the basis of State Finance Commission recommendations. Thus, it plays a limited role in strengthening and building the capacity of local self-government.

- Implementational Challenges – The recommendations made by the Commission are only advisory in nature. This makes it challenging for the commission to ensure that its recommendations are properly implemented and monitored.

Way Foward

- Permanence – PV Rajamannar Committee’s recommendation of making the Commission a permanent body should be considered.

- Strengthening Capacity – The Commission should bolster its analytical and advisory capabilities to enhance its effectiveness. This involves leveraging reliable data sources, employing robust methodologies, and engaging with experts and stakeholders.

- Enhanced Consultation – The Commission should improve communication and outreach strategies to disseminate their reports widely, solicit feedback, and foster consensus among stakeholders.

- Promotion of Cooperative & Competitive Federalism – The Commission should explore innovative approaches to foster cooperative and competitive federalism, adapting to emerging realities effectively.

- Addressing Emerging Issues – In response to evolving economic and social dynamics, The Commission need to remain proactive and responsive. This entails addressing challenges stemming from GST implementation, the Covid-19 Pandemic, Climate Change, and Digital Transformation.

Conclusion

In conclusion, the FCI stands as a crucial pillar of fiscal federalism, ensuring the equitable distribution of financial resources between the Union and State Governments. As India continues on its path of economic development and social progress, the purpose of Finance Commission will continue to remain indispensable. Taking the necessary steps to address the challenges faced by it will go a long way in fostering balanced regional development and ensuring the financial stability of the nation.

15th Finance Commission of India

| 1. The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh. 2. Its recommendations will cover a period of five years from the year 2021-22 to 2025-26. |

16th Finance Commission of India

| 1. Constitution: The Sixteenth Finance Commission was constituted on 31.12.2023 with Shri Arvind Panagariya as its Chairman. a. The Commission has been requested to make its recommendations available by 31.10.2025, covering an award period of 5 years commencing from 1st April 2026. 2. Terms of Reference: The Finance Commission shall make recommendations as to the following matters, namely: a. The distribution between the Union and the States of the net proceeds of taxes which are to be, or maybe, divided between them and the allocation between the States of the respective shares of such proceeds; b. The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States by way of grants-in-aid of their revenues under Article 275 of the Constitution for purposes other than those specified in the provisos to clause (1) of that article; and c. The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State. d. The Commission may review the current financing structures related to Disaster Management initiatives. This involves examining the funds created under the Disaster Management Act of 2005 and presenting suitable recommendations for improvements or alterations. |

Frequently Asked Questions (FAQs)

Who Constitutes the Finance Commission of India?

The President of India constitutes the Finance Commission of India.

Who Constitutes the Finance Commission for a State?

The Governor constitutes the Finance Commission for a State.

What are Some of the Finance Commission’s Successful Recommendations?

Some of the successful recommendations of the Finance Commission are as follows:

– To introduce tax devolution as a major component of vertical transfers, increasing the share of states from 10% to 42% over time.

– To introduce performance-based incentives for States to encourage fiscal discipline, fiscal prudence, efficient governance, sustainable development, etc.

– To introduce disaster relief funds for States and local bodies and provide financial assistance for preparedness, mitigation, and relief efforts.

– To allocate the grants to empower local bodies for service delivery, and infrastructure development and to enhance fiscal autonomy, accountability, and governance at the grassroots level.

What is the Finance Commission?

The Finance Commission is a constitutional body in India established to define the financial relationship between the central government and the state governments.

Is the Finance Commission a constitutional body?

Yes, the Finance Commission is a constitutional body established under Article 280 of the Indian Constitution.

What are the articles related to the Finance Commission?

The key article related to the Finance Commission is Article 280 of the Constitution, which outlines its establishment, composition, and duties. Additionally, Articles 268 to 281 broadly address the distribution of financial resources between the Centre and the states.

Who is the present Finance Commissioner of India?

As of now, the Chairman of the 15th Finance Commission is Arvind Panagariya.