The Insolvency and Bankruptcy Code 2016 (IBC 2016) is a landmark reform aimed at addressing multiple challenges in the Indian economy. By addressing the inefficiencies in India’s insolvency and bankruptcy processes, it has improved the resolution of stressed assets along with promoting entrepreneurship. This article aims to study in detail the Insolvency and Bankruptcy Code 2016 (IBC 2016), its needs, provisions, achievements, concerns and other related concepts.

What is Insolvency and Bankruptcy Code 2016 (IBC 2016)?

- Insolvency and Bankruptcy Code is a legislation enacted in 2016 based on the ‘T.K Vishwanathan Committee Report’.

- It consolidates various laws pertaining to the resolution of insolvency of businesses and firms.

- It establishes streamlined and expedited insolvency procedures to assist creditors, such as banks, in recovering dues and mitigating bad loans, which are a significant burden on the economy.

- It is also known as the exit law of India.

What is Insolvency?

- Insolvency refers to a situation where individuals or companies cannot repay back their outstanding debt obligations.

What is Bankruptcy?

- Bankruptcy refers to a legal status declared by a court of competent jurisdiction for a person or entity that is insolvent i.e. unable to pay off debts.

- The court issues appropriate orders to resolve the insolvency and protect the rights of creditors.

Objectives of Insolvency and Bankruptcy Code

Major objectives of the Insolvency and Bankruptcy Code are as follows:

- To consolidate and amend all insolvency laws that are existing in India.

- To simplify and expedite the process of resolution of Insolvency and Bankruptcy in India.

- To protect the interest of creditors, including stakeholders in a company.

- To revive the company in a time-bound manner.

- To promote entrepreneurship.

- To get the necessary relief to the creditors and consequently increase the credit supply in the economy.

- To work out a new and timely recovery procedure to be adopted by the banks, financial institutions or individuals.

- To set up an Insolvency and Bankruptcy Board of India.

- Maximization of the value of assets of corporate persons.

Need for Insolvency and Bankruptcy Code (IBC)

The need for a new Insolvency and Bankruptcy Code can be seen as follows:

- Previously, India had several overlapping laws and adjudicating forums aimed to address financial failure and insolvency of companies and individuals.

- This led to undue delays in the recovery of the NPAs by the Banks.

- The Insolvency and Bankruptcy Code (IBC Code) was needed to consolidate all the laws related to Insolvency and Bankruptcy resolution and to simplify the process of insolvency resolution.

Institutional Mechanism of IBC

The institutional mechanism of the Insolvency and Bankruptcy Code includes the following:

Insolvency Professionals (IPs)

Insolvency Professions (IPs) are a specialized cadre of licensed professionals who administer the process of insolvency resolution, manage the debtors’ assets, and provide information for creditors to assist them in decision-making.

Insolvency Professional Agencies

Insolvency Professional Agencies are tasked with conducting examinations to certify the Insolvency Professionals (IPs) and enforcing a code of conduct for their performance.

Information Utilities

The creditors would report financial information of the debt owed to them by the debtor.

Adjudicating Authorities

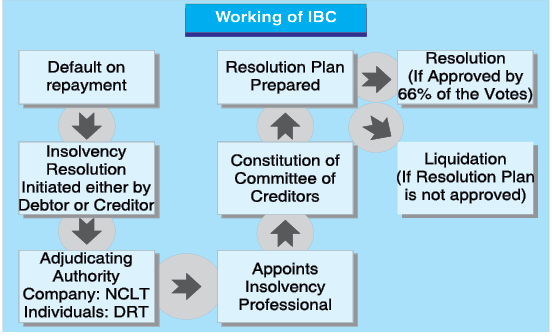

- The proceedings of the resolution process are to be adjudicated by

- National Companies Law Tribunal (NCLT) in case of companies; and

- Debt Recovery Tribunal (DRT) in case of individuals.

- The duties of the authorities includes the approval to initiate the process of resolution, appointing the insolvency professional, and approving the final decision of creditors.

Committee of Creditors (CoC)

- During the insolvency resolution process, a committee of lenders is formed to make decisions on the resolution process through voting.

- The CoC may either decide to restructure the debts of the debtors by preparing a resolution plan or liquidate the assets of the debtors.

- However, such a decision must be approved by at least 66% of the total votes in the Committee of Creditors (CoC).

Insolvency and Bankruptcy Board

- The Insolvency and Bankruptcy Board is mandated with regulating the Insolvency Professionals (IPs), Insolvency Professional Agencies (IPAs), and Information Utilities (IUs).

- The Board would comprise of representatives of the Reserve Bank of India (RBI), along with the Union Ministries of Finance, Corporate Affairs and Law.

Insolvency Resolution Process under IBC

The chronological order of resolution process under the Insolvency and Bankruptcy Code (IBC Code) is as follows:

- When a default occurs, either the debtor or creditor may initiate the resolution process before the adjudicating authority.

- The NCLT appoints an Insolvency Professional (IP) to administer the Insolvency Resolution Process (IRP).

- The Insolvency Professional (IP) identifies the financial creditors and then constitutes a Committee of Creditors (CoC).

- The CoC prepares the plan of resolution for the restructuring the loans of the defaulted borrower which may be in the form of extending the maturity period of the loan, reducing the rate of interest on loans etc.

- Such a resolution plan must be approved by at least 66% of the total votes in the Committee of Creditors (CoC).

Priority of Claims under IBC

The Insolvency and Bankruptcy Code significantly changes the priority waterfall for the distribution of liquidation proceeds.

- Insolvency resolution process costs and the liquidation costs to be paid in full.

- Claims of secured creditors and workmen are due up to 24 months.

- Employees’ salaries upto 12 months.

- Financial debt owed to unsecured creditors.

- Government dues (2 years) and unpaid dues to secured creditors.

- Any remaining debt and dues.

- Equity.

Achievements of Insolvency and Bankruptcy Code 2016 (IBC 2016)

- Improved Legal Provision: Insolvency and Bankruptcy Code (IBC Code) is a vast improvement on the two earlier laws for recovering bad loans:

- Sick Industrial Companies (Special Provisions) Act, 1985 (SICA), and

- Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDDB).

- Addressing Chakravyuha Challenge: It addresses the Chakravyuha challenge of Indian Economy

- 1991 LPG Reforms has enabled easier entry of private sector but made the exit difficult.

- Old Inefficient firms continue to operate with highly efficient firms leading to misallocation of factors of production.

- Speedier Resolution: Introduction of Insolvency and Bankruptcy Code has brought down the average time for resolution processes from earlier 4-6 years to just around 317 days at present.

- Higher Recoveries: Recoveries are also higher: 45% after its introduction, against 26% before it.

- Ease of Doing Business (EoDB): Post introduction of the Insolvency and Bankruptcy Code (IBC Code), many business entities can be seen paying up front before being declared insolvent. Moreover, many cases have been resolved even before it was referred to NCLT.

- Behavioural Change: The Fear of losing control of the company forces the promoters to operate at highest level of efficiency. This encourages the borrowers to settle dues at the earliest.

- Overall Improved Performance: India’s Ranking in resolving insolvency has improved significantly from 136 in 2017 to 52 in 2020, as reported by World Bank.

Challenges for Insolvency and Bankruptcy Code

- Lack of operational NCLT benches: Most of the single and division benches of NCLT remain non-operational or partly operational on account of a lack of adequate support staff and proper infrastructure.

- Low approval rate of resolution plans: As per the Insolvency and Bankruptcy Board of India’s data, only 60% of the cases have been closed, and the majority of the cases have been closed through liquidation, only a few cases have been closed due to resolution.

- High number of liquidations is a cause for major worry as it violates IBC’s principal objective of resolving bankruptcy.

- Delay in Process: Delay in admission of Applications and Approval of Resolution plans and slow judicial process in India allows the resolution processes to drag on.

- Low Recovery Rate: Recovery rates have, on average, been low.

- Moreover, when a few large recovery cases are excluded from accounting, a recovery rate of around 35-36% is observed.

Conclusion

The Insolvency and Bankruptcy Code (IBC) has led to significance improvements in India’s insolvency landscape, providing a robust framework for the resolution of distressed assets. By fostering a culture of credit discipline, promoting entrepreneurial ventures, and ensuring the efficient use of resources, it has set the stage for a more resilient and dynamic economy. Ongoing efforts to refine and strengthen the code will be crucial for managing the complexities of insolvency and bankruptcy in the future.

Insolvency and Bankruptcy (Amendment) Act, 2021

The Insolvency and Bankruptcy (Amendment) Act, 2021 introduced an alternate insolvency resolution process for Micro, Small and Medium Enterprises (MSMEs) with defaults up to ₹1 crore called the Pre-packaged Insolvency Resolution Process (PIRP).

GS - 3