Balance of Payments (BoP) is an important economic parameter, crucial for an economy. It offers critical insights into a country’s economic health, guiding policymakers in shaping effective fiscal and trade policies. This article aims to study in detail the Balance of Payments (BoP), its meaning, components, and related concepts such as Balance of Trade (BoT), Disequilibrium in Balance of Payments, and Measures to tackle it.

What is Balance of Payments (BoP)?

- The Balance of Payments (BoP) encompasses all economic transactions between a country’s residents and its non-residents in a particular period (generally over a year) involving goods, services, income, transfers such as gifts, foreign investments, and loans, etc.

- These transactions are made by government bodies, firms, and individuals.

- Balance of Payments (BoP) is also known as the Balance of International Payments.

Importance of Balance of Payments (BoP)

- Depicts the financial and economic status of a country.

- Can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating.

- Helps the Government to decide on fiscal and trade policies. Provides important information to analyze and understand the economic dealings of a country with other countries.

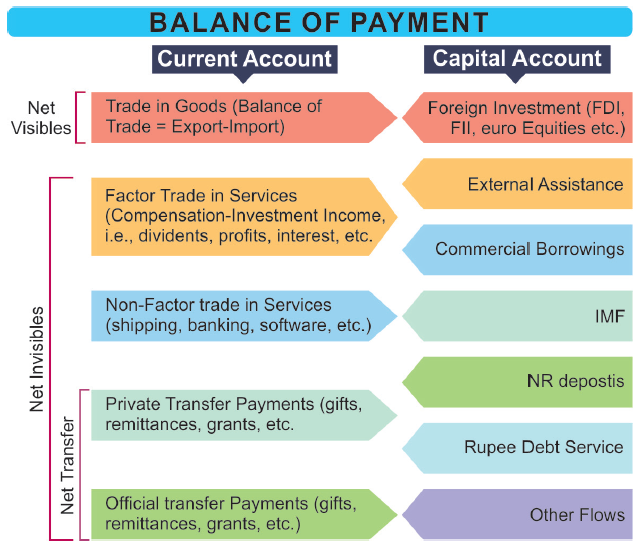

Components of Balance of Payments

The components of Balance of Payments (BoP) have been described in the sections that follow.

Current Account

- The Current Account records the flow of goods, services, and investments into and out of the country.

- Thus, it represents a country’s foreign transactions.

- It is a component of the Balance of Payments of a nation.

- Various components of the Current Account include – the Balance of Trade (exports minus imports of goods), net services (export minus import), net primary income or factor income (i.e. earnings on foreign investments minus payments made to foreign investors), and net cash transfers, that have taken place over a given period of time.

Current Account = Trade gap + Net current transfers + Net income abroad

Trade Gap = Exports – Imports

- A positive current account balance means that the country is a net lender to other countries, whereas a negative current account balance means that it is a net borrower from the rest of the world.

- A Current Account Surplus increases the net foreign assets of the nation by the amount of the surplus, while a current account deficit reduces it by the same amount.

Generally, the Balance of Trade (BoT) component is the biggest factor in making a Current Account Deficit or Surplus.

Capital Account

- The Capital Account records all the international sales and purchases of assets such as money, stocks, bonds, etc

- The capital account includes net external borrowings/Loans/Assistance as well as Foreign Direct Investment (FDI), portfolio and other investments.

- A capital account deficit indicates that more money is leaving the economy, along with an increase in the country’s ownership of foreign assets, whereas a surplus shows more money flowing into the economy.

Errors and Omissions

- Sometimes the Balance of Payments does not balance.

- This imbalance is shown as Errors and Omissions in the BoP.

- It indicates the country’s inability to accurately record all international transactions.

Changes in Foreign Exchange Reserves

- Movements in the reserves comprise changes in the foreign currency assets held by the Reserve Bank of India (RBI) as well as in Special Drawing Rights (SDR) balances.

Differences between Balance of Trade and Balance of Payment

| Dimensions | Balance of Trade | Balance of Payment |

|---|---|---|

| Definition | Balance of Trade (BoT) is a statement that records the country’s imports and exports of goods with the remaining world. | Balance of Payments (BoP) is a statement that records all economic transactions done by the country with the remaining world. |

| Record | Transactions of goods only. | Transactions of both goods and services. |

| Capital Transfers | Excluded | Included |

| Economic Status | It gives only a partial view of the country’s economic status. | It gives a complete view of the economic position of the country. |

| Component | It is a component of Current Account of Balance of Payment. | Current Account and Capital Account are its components |

| Outcome | It can be Favorable, Unfavorable or balanced. | Both the receipts and payment sides tallies. |

Balance of Payments and Foreign Reserve (Forex)

- For the purpose of accounting, at broader level, Central Bank’s reserve account (forex) is also included into Capital Account of the Balance of Payments (BoP).

- In an ideal scenario, when all components of the Balance of Payments accounts are considered, their total should balance to zero, resulting in neither an overall surplus nor a deficit.

- This is the reason the term ‘Balance’ is used in Balance of Payments.

Disequilibrium of Balance of Payments (BoP)

- If we add the current account and the capital account excluding the central bank’s reserve account imbalances (Disequilibrium) is possible, for example, more imports than exports(and hence demand of foreign currency exceeds its supply) or vice–versa.

- This deficit or surplus needs to be counterbalanced from the Foreign Reserve of the country in order to make net zero Balance of Payments.

- Hence, a Balance of Payments (excluding forex) surplus (or deficit) is accompanied by an accumulation (or de-accumulation) of foreign exchange reserves.

Causes of Disequilibrium in BoP

Some of the major factors responsible for disequilibirum in Balance of Payments can be seen under the following heads:

Economic Factors

- Structural changes in the economy. Imbalance between exports and imports.

- Large scale development expenditure which is responsible for large imports.

- High domestic prices which lead to imports.

- Cyclical fluctuations (like recession or depression) in general business activity.

- New sources of supply and new substitutes.

- Inflation/Deflation.

Political Factors

- High population growth in poor countries adversely affects their Balance of Payments because it increases the needs of the countries for imports and decreases their capacity to export.

- Political instability and disturbances like war, change in diplomatic policy which causes large capital outflows and hinder Inflows of foreign capital.

Social Factors

- Changes in fashions, tastes and preferences of the people which is influencing imports and exports.

Types of Disequilibrium of Balance of Payments (BoP)

Disequilibrium in Balance of Payments can be classified as follows:

Temporary Disequilibrium

- Temporary disequilibrium in the form of deficits or surpluses tend to last for a short period of time.

- They are the result of temporary changes in the economy like – crop failure, seasonal fluctuations, effect of weather on agricultural production, etc.

- Such a disequilibrium may occur once a while and gets automatically corrected. It does not pose a serious problem for a country.

Fundamental Disequilibrium

- There is no precise definition of the term fundamental disequilibrium. Economists generally define fundamental disequilibrium as – “a deep rooted persistent deficit or surplus in the BOP of a country.”

- It is a chronic BOP deficit, according to IMF. It is of long term nature and a matter of serious concern for the country.

Cyclical Disequilibrium

- Cyclical fluctuations in the business activity also lead to Balance of Payments disequilibrium.

- Cyclical disequilibrium occurs because of the following reasons:

- Trade cycles follow different paths and patterns in different countries.

- Different countries follow different stabilization programmes.

- Difference in the price and income elasticity of demands for imports.

Structural Disequilibrium

- Structural disequilibrium occurs due to structural changes in the economy.

- Some of the structural changes would include changes in technology, changes in tastes and preferences, changes in long term capital movements, etc.

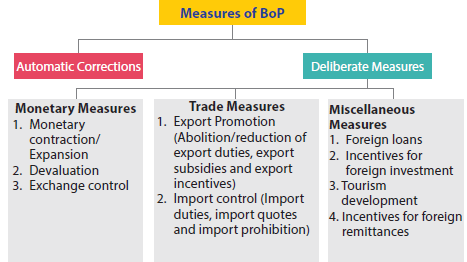

Measures to Overcome Imbalances in BoP

Automatic Correction

- Under automatic correction, the BOP adjustment comes about automatically, and it is not brought about deliberately by government policy or intervention.

- The burden of adjustment is on the economy and market forces and not on the government.

- Assuming fixed or flexible exchange rates, the automatic adjustment in BOP takes place through changes in prices, interest rates, income, and capital flows.

Deliberate Measures

Monetary Measures

- Monetary Contraction

- The level of aggregate domestic demand, domestic price level and the demand for imports and exports may be influenced by contraction or expansion of money supply so that balance of payments disequilibrium may be corrected.

- Contraction of money supply is most likely to reduce the purchasing power and, hence the aggregate demand.

- It is also likely to lower domestic prices, which, in turn, reduces the demand for imports and increases exports.

- Thus, the fall in imports and rise in exports would help correct the disequilibrium.

- Devaluation

- It means reduction of the official rate at which the domestic currency is exchanged for another currency.

- A country experiencing fundamental disequilibrium in its Balance of Payments (BoP) may devalue its currency to boost exports and reduce imports, thus correcting the imbalance.

- Devaluation makes export of goods cheaper and imports dearer.

- Exchange Control

- It is a popular strategy employed to influence the balance of payments positions of a country.

- Under this method, the government or central bank assumes full control over the foreign exchange reserves and earnings of the country.

- Recipients of foreign exchange, such as exporters, are required to surrender their foreign exchange to the government’s central bank, in exchange for the country’s domestic currency.

- Through its control over the use of foreign exchange, the government can control imports.

Trade Measures

- Export Promotion

- Export promotion includes the reduction and abolition of the export duties, providing export subsidy, encouraging export production and export marketing by giving monetary, fiscal, physical and institutional incentives and facilities.

- Import Control

- Import Control can be done by enhancing import duties, restricting imports through import quotas, licensing and even prohibiting altogether the import of certain inessential items.

Miscellaneous Measures

Some miscellaneous measures like foreign loans, Incentives to promote foreign investments and remittances, development of tourism can be used to control BoP imbalances.

- Foreign Loans: Deficit BoP can be corrected by government borrowing from foreign banks etc.

- Foreign Investments: By attracting foreigners in the country by offering them various incentives and concessions so that there is more capital inflow in the economy that helps government reduce deficit in BOP account.

- Tourism Development: Increasing tourist by offering them various facilities like good hotels, transportation facility, concessional travel etc. this would increase the foreign exchange earnings of the country.

- Foreign Remittances: Government gives incentives to people working abroad. This helps in inflow of foreign exchange.

- Import Substitution: Producing substitutes of imported goods by providing various incentives and concessions to the domestic industries. This replaces foreign exchange outflow.

Balance of Payments Crisis (BoP Crisis)

- A Balance of Payments Crisis (BoP Crisis) is also called a currency crisis.

- It refers to a situation when a country is unable to pay for its essential imports or service its debt repayments.

- This leads to a rapid decline in the value of the currency of affected nation.

- BoP Crises are, usually, preceded by large capital inflows in the country, which leads to rapid economic growth initially.

- Over time, however, overseas investors may become worried about the level of debt generated by their inbound capital and hence decide to withdraw their investments.

- The resulting capital outflows leads to a rapid drop in the value of the currency of the affected nation.

- This creates problems for firms in the affected country that have received inbound investments and loans, as their revenues are usually earned domestically while their debts are denominated in a reserve currency.

- Once the nation’s government has depleted its foreign reserves in an effort to support the value of the domestic currency, its policy options become significantly restricted.

- The government can increase interest rates to help prevent further declines in the value of its currency. While this may benefit those with debts denominated in foreign currencies, it typically puts further strain on the local economy.

Role of Global Institutions in Tackling BoP Crisis

Role of IMF in Tackling BoP Crisis

- The International Monetary Fund (IMF) is a global organization which aims to help countries stabilize exchange rates and provide loans to countries in need.

- IMF lending, aims to give countries breathing room to implement adjustment policies and reforms that will restore conditions for strong and sustainable growth, employment, and social investment. These policies will vary depending upon the country’s circumstances, including the causes of the problems.

- When a country suffers from a deficit in its balance of payments on current account, it can obtain from the IMF, in exchange for its own currency, the currency which it needs to pay off its deficit. There is, however, a limit to the amount which it can thus obtain.

Role of BRICS Contingent Reserve Arrangement (CRA) in Tackling BoP

- The BRICS CRA has proposed offering short-term liquidity support to its members through currency swaps to help mitigate a BoP crisis if such a situation arises.

Conclusion

The Balance of Payments (BoP) is a vital tool for assessing a country’s economic health and its interactions with the global economy. By analyzing the current and capital accounts, policymakers and economists can gauge a nation’s trade performance, investment flows, and overall financial stability. Addressing imbalances in the BoP through various measures, such as monetary policy adjustments, trade regulations, and international assistance, is crucial for maintaining economic stability.

GS - 3