Banking System in India or Indian Banking System is the cornerstone of the nation’s economic framework. By channeling funds from savers to borrowers, and facilitating investment and individual financial needs, it plays a crucial role in the country’s economic development. Understanding the structure and functions of the Indian Banking System is essential for developing a grasp of the Indian Financial System. This article aims to study in detail the Banking System in India, including its classification, structure, types of banks, and other related concepts.

What is Banking System in India?

Banking System in India or Indian Banking System or Banking Sector in India refers to a network of financial institutions, such as banks and credit unions, that handle financial transactions and provide financial services to individuals, businesses, and governments. These institutions, primarily, act as intermediaries between people with money i.e. savers, and those who need money i.e. borrowers. The types of services offered by the banking institutions, usually, include accepting deposits, lending money, facilitating transactions, and offering various financial products like savings accounts, loans, and credit cards.

Classification of Banks in India

Banks, forming part of the Banking System in India, can be divided into two categories – Scheduled Banks and Non-Scheduled Banks.

Scheduled Banks

Scheduled Banks under the Banking System in India refer to those financial institutions that are listed in the 2nd Schedule of the Reserve Bank of India Act, 1934. This inclusion signifies that they meet specific criteria set by the RBI and are subject to its stricter regulations.

A bank to be listed in the schedule has to satisfy the following 2 conditions:

- It should have paid-up capital and reserves of not less than 5 lacs, and

- It should satisfy the RBI that their affairs are not being conducted in a manner detrimental to the interest of their depositors.

If any Scheduled Bank violates these conditions, it gets de-listed from the schedule.

A Scheduled Bank gets the following benefits:

- Facility of loans on Bank Rate from RBI.

- Automatic membership of Clearing House.

- Facility of Re-Discount of first-class exchange bills from RBI.

Non-Scheduled Banks

Non-Scheduled Banks under the Banking System in India refer to those financial institutions that don’t meet the criteria to be included in the 2nd Schedule of the Reserve Bank of India Act, 1934. Being excluded from the schedule means they operate under a different set of regulations as compared to Scheduled Banks.

Difference between Scheduled Banks and Non-Scheduled Banks

| Basis of Difference | Scheduled Banks | Non-Scheduled Banks |

|---|---|---|

| Meaning | A banking company under the Banking System in India which is listed in the second schedule of the RBI Act 1934. | A banking company under the Banking System in India that is not mentioned in the second schedule of the RBI Act 1934. |

| Criteria | – Should have a paid-up capital of `5 lakhs or more. – Have to ensure that its affairs are not conducted in a manner detrimental to the interest of its depositors. | – No fixed criteria as such. |

| Regulatory Requirements | – Have to keep CRR deposits with the Reserve Bank of India. – Required to file their returns on a periodic basis. | – Have to maintain CRR deposits with themselves. – No requirements of filing returns as such. |

| Rights Available | – Authorized to borrow funds from the RBI. – Can apply to join the clearinghouse. – Can avail of the facility of rediscount of first-class exchange bills from RBI. | – Usually, not authorized to borrow funds from the RBI. However, they can borrow from the RBI under emergency conditions. – Not eligible for membership in the clearinghouse. – Facility of rediscounting exchange bills from RBI is not available for them. |

| Risk | They are financially stable and are unlikely to hurt the rights of the depositors. | These banks are riskier to do business. |

| Examples | Most of the banks under the Banking System in India are Scheduled Banks. For example, Commercial Banks, Private, and Public Sector Banks. | Only a few types of banks under the Banking System in India are Non-Scheduled Banks. For example, Local Area Banks (LABs), and some Urban Cooperative Banks (UCBs). |

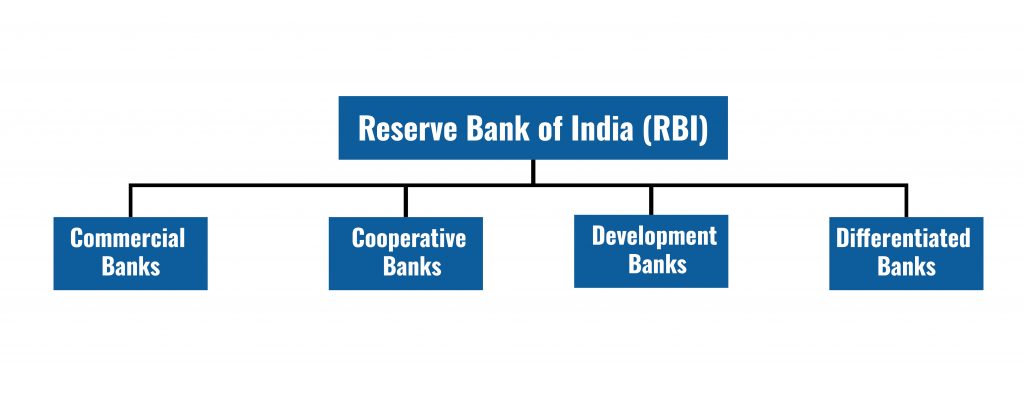

Structure of Banking System in India

The Reserve Bank of India (RBI) sits at the top of the structure of the Banking System in India and acts as the central bank of India. Beneath the central bank operates various types of banks as discussed in the sections that follow.

Reserve Bank of India (RBI)

- The Reserve Bank of India (RBI) is the Central Bank of India, meaning that it is the apex body in the Banking System in India.

- It is owned by the Union Ministry of Finance.

- It acts as a regulatory body, responsible for the regulation of the Indian banking system as well as the control, issuing, and maintaining money supply in the Indian economy.

Its Objectives, History, Structure, Functions, and Other Related Concepts can be studied in our detailed article on the Reserve Bank of India (RBI).

Commercial Banks

- Commercial Banks refer to those banks under the Banking System in India that run on a commercial basis. It means that they operate and offer services to earn a profit.

- They are regulated under the Banking Regulation Act, 1949.

Their Structure, Types, Importance, and Other Related Concepts can be studied in our detailed article on Commercial Banks in India.

Cooperative Banks

- Cooperative Banks refer to those financial institutions under the Banking System in India that operate on the principles of cooperation and mutual benefit for their members.

- They belong to their members who are both the owners and customers of the bank.

- Thus, it can be said that the customers are the owners of these banks.

- Cooperative Banks are named so because these have the cooperation of stakeholders as the motive.

Their Features, Regulations, Structure, Significance, and Other Related Concepts related to Cooperative Banks can be studied in our detailed article on Cooperative Banks in India.

Development Banks

- Development Banks are also known as Term-Lending Institutions (TLIs) or Development Finance Institutions (DFIs).

- They are specialized financial institutions under the Banking System in India that provide long-term finance and support to the sectors of the Indian economy which possess higher risks and cannot have access to adequate loans from Commercial Banks.

Their Types, Roles, and Other Related Concepts can be studied in our detailed article on Development Banks in India.

Differentiated Banks

- Differentiated Banks under the Indian Banking System refer to those banks that cater to a specific segment of customers.

- The concept of Differentiated Banks was introduced in the Banking System in India by the RBI based on the recommendations of the Nachiket Mor Committee in 2013 in order to offer specialized services or unique products designed specifically to suit a particular sector.

Their Types, Roles, and Other Related Concepts can be studied in our detailed article on Differentiated Banks in India.

Non-Banking Finance Companies (NBFCs)

- A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

- They are not considered part of the traditional Banking System in India, but they do operate within the larger financial system regulated by the RBI.

- NBFC’s financial assets should constitute more than 50% of the total assets and income from financial assets should constitute more than 50% of the gross income.

- While some NBFCs are regulated by the RBI, others are regulated by other regulatory bodies.

- For example, Merchant Banking Companies are regulated by SEBI, and Insurance Companies are regulated by IRDA.

Difference between NBFCs and Banks

| Banks | Non-Banking Financial Companies (NBFCs) |

|---|---|

| Banks can accept Demand Deposits | NBFCs cannot accept Demand Deposits. |

| Banks are a part of the Payment and Settlement System (PSS), and hence can issue cheques drawn on itself. | NBFCs do not form a part of the Payment and Settlement System (PSS), and hence cannot issue cheques drawn on itself. |

| Bank Deposits are insured by the Deposit Insurance of Deposit Insurance and Credit Guarantee Corporation (DICGC). | Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs. |

| Banks are required to maintain Reserve Ratios prescribed by the RBI, such as CRR, SLR, etc. | NBFCs are not required to maintain Reserve Ratios prescribed by the RBI, such as CRR, SLR, etc. |

| Banks are regulated under Banking Regulation Act, 1949. | NBFCs are regulated under Companies Act, 1956. |

| FDI is allowed upto 74% for Private Sector Banks. | FDI is allowed upto 100% for NBFCs. |

Basel Norms or Basel Accords

- In the era of globalization, there are many banks which operate internationally. Failure in any such banks may trigger a relatively large number of simultaneous failures within the financial sector. Basel Norms are devised to avoid this.

- They aim to strengthen regulation, supervision, and risk management of the banking sector in India and the world to improve its ability to absorb shocks arising from financial and economic stress.

- Basel Norms are fixed by the Basel Committee on Banking Supervision (BCBS) – a part of the Bank for International Settlements (BIS), Switzerland, which is a coordinating agency for Central Banks of various countries.

- These norms are applicable to individual banks and Systemically Important Financial Institutions (SIFIs).

- Their implementation is done by the Central Banks of the respective countries.

- So far, 3 sets of Basel Norms have been developed – Basel I, Basel II, and Basel III.

Basel I Norms

- The first Basel Accord, known as Basel I, was issued in 1988

- It focused on credit risks and defined capital and structure of risk weights for banks

- The minimum capital requirement was fixed at 8% of the Risk-Weighted Assets (RWA)

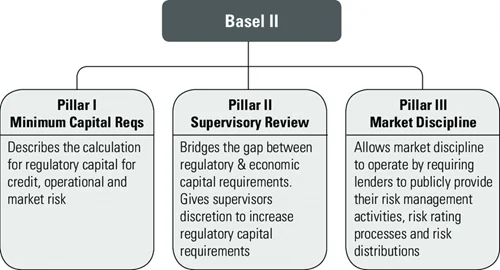

Basel II Norms

- It is the refined and reformed version of Basel I, which was published in 2004.

- It defined 3 types of risks – Operational Risks, Capital Risks, and Market Risks.

- Its 3 main pillars of Basel II were as follows:

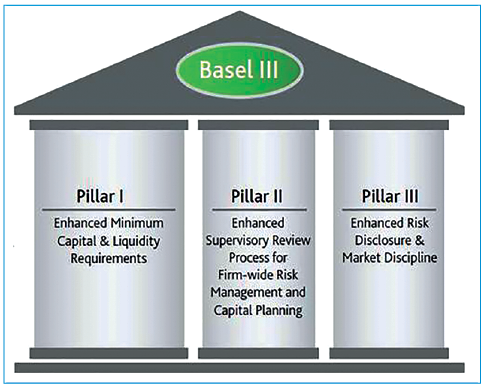

Basel III Norms

- Basel III guidelines were released in December 2010 in the backdrop of the financial crisis of 2008.

- The guidelines aim to promote a more resilient banking system by focusing on four vital banking parameters viz. capital, leverage, funding, and liquidity.

- The 3 main pillars of Basel III are as follows:

Capital-to-Risk Weighted Asset Ratio (CRAR) or Capital Adequacy Ratio (CAR)

- Capital-to-Risk Weighted Asset Ratio (CRAR) or Capital Adequacy Ratio (CAR) refers to the availability of sufficient capital as a %ge of risk-weighted assets. Thus,

CRAR = (Total Capital/Total Risk-Weighted Assets) * 100

- Where, Total Risk-Weighted Capital = Weighted average of total capital assets held by the bank.

- CRAR is fixed under Basal Norms.

- The principle behind fixing CRAR is that banks should have an adequate amount of their own capital to cover risks arising from Bad Assets (Bad Loans)

- For the calculation of CRAR, the loan amount given in each sector is to be multiplied by the presumed risk percentage of a specific sector. The product gives the amount of risk-weighted assets. For example,

| Purpose of Loan | Loan Amount (in ₹) | Risk Percentage | Risk Weighted Assets (RWA) (in ₹) |

|---|---|---|---|

| Agriculture | 100 | 20% | 20 |

| Industry | 200 | 17.5% | 35 |

| Government | 100 | 5% | 5 |

| Total | 400 | 60 |

Related Concepts

Domestic Systemically Important Banks (D-SIBs)

- Domestic Systemically Important Banks (D-SIBs) under the Banking System in India refer to those banks that are ‘Too Big to Fail (TBTF)’.

- Due to this perception, these banks enjoy certain advantages in the funding markets.

- D-SIBs in India are recognized by the RBI under its framework issued in 2014.

- Usually, the banks whose assets exceed 2% of the GDP of India are considered as D-SIBs.

- As of now, the State Bank of India (SBI), ICICI Bank, and HDFC Bank have been identified as D-SIBs by the RBI.

Neo Banks

- Neobanks refers to the ‘fintech firms’ that solely have a digital presence, without any physical branches.

- Neobanks aims to give customers a cheaper alternative to traditional banks by leveraging technology to offer personalized services to customers while minimizing operating costs.

- There are 2 types of Neobank models in India:

- Neobank doesn’t have a banking license themselves and instead partners up with a traditional bank to provide their products,

- Neobanks obtain banking licenses themselves to operate fully on their own.

- Examples of neobanks in India include – RazorpayX, Jupiter, Neo, Epifi, and Open.

Banking System in India or Indian Banking System is a dynamic and evolving entity, continuously adapting to meet the changing needs of the economy and its citizens. As India marches towards a more digital and inclusive future, the Banking System in India will undoubtedly play a critical role in ensuring sustainable economic growth and prosperity.

GS - 3