Base Erosion and Profit Shifting (BEPS) has become a major issue of concern for economies worldwide. With a significant amount of dent to the government revenue, this is of particular concern for a developing country like India. This article aims to study in detail Base Erosion and Profit Shifting, its meaning, techniques, repercussions, measures taken to curb it and other related concepts.

What is Base Erosion and Profit Shifting (BEPS)?

- Base Erosion and Profit Shifting (BEPS) refers to tax avoidance strategies that takes advantage of loopholes and mismatches in tax laws to artificially shift profits to low or no-tax locations.

- Firms make profits in one jurisdiction (country), and shift them in another jurisdiction (country) by exploiting gaps and mismatches in tax rules, to take advantage of lower tax rates.

- Thus, they avoid paying taxes in the country where the profit is made.

Impacts of Base Erosion and Profit Shifting

- As per Organisation for Economic Cooperation and Development data, BEPS practice is a major problem, causing nations to loose tax revenues to the tune of $ 100 billion to $ 240 billion annually.

- This lost revenue is equivalent to 4-10 % of the total income tax revenue at the global level.

- It allows businesses operating across borders to gain a competitive advantage over enterprises operating at the domestic level.

- This, in turn, undermines the integrity and fairness of tax systems.

- As taxpayers see multinational corporations legally avoiding paying tax, they also feel an urge for tax avoidance.

- Thus, it undermines voluntary compliance by taxpayers.

- Base Erosion and Profit Shifting is of major concern for developing countries as they are heavily dependent on corporate income tax, particularly from multinational enterprises.

BEPS Project of OECD

- Organisation for Economic Cooperation and Development (OECD) launched the BEPS project to tackle the problem of tax avoidance, to bring in a transparent tax environment and to bring more synergy to the international tax regimes.

- It consists of 15 Action Plans, which are being adopted and implemented by 135 countries.

- It provides countries necessary tools to tax the company that is generating profits in that particular country.

- These tools also reduce disputes.

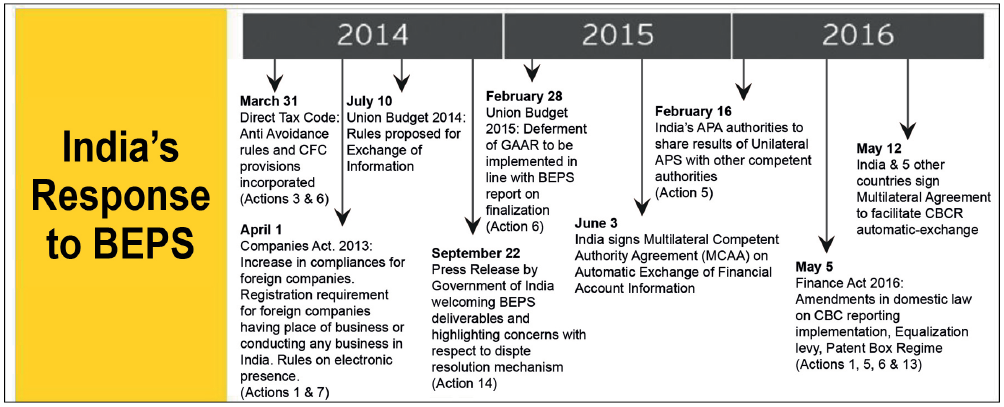

Recent Efforts by India to Curb BEPS

- India has signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”), which aims to implement a set of tax treaty measures to update international tax regimes and reduce chances of tax avoidance by multinational enterprises.

- The convention aims to amend India’s treaties to prevent revenue loss caused by treaty abuse and Base Erosion and Profit Shifting strategies. It ensures that profits are taxed in the jurisdictions where the substantial economic activities generating those profits take place.

- India has also signed the Inter-Government Agreement (IGA) on the Foreign Account Tax Compliance Act (FATCA) with the United States.

- India also has become a signatory of the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information in 2015.

- India and the US signed an agreement for exchange of country-by-country report to enable the two countries to automatically exchange the reports filed by the ultimate parent entities of the multinational enterprises in the respective jurisdictions for the years commencing on or after January 1, 2016.

- In Union Budget 2016 an ‘equalisation levy’ of 6 per cent on payments exceeding over ₹1 lakh to online ad services from non-resident entities was introduced.

- India is the first country to impose such a levy, post the OECD action plans.

- A tax panel has recommended expanding the ambit of this levy to cover a wide gamut of transactions, including website designing, hosting and maintenance, online marketing, cloud computing, online use of or download of software and applications, and platforms for the sale of goods and services.

- India introduced core elements of the Country-by-Country reporting requirement in the Indian Income Tax Act, 196 through Finance Act 2016, effective from 1 April 2016.

- India is also a part of negotiations with respect to G7’s Framework for a Global Minimum Tax.

Conclusion

Addressing Base Erosion and Profit Shifting (BEPS) is important for maintaining the integrity of the global tax system, ensuring fairness, and securing revenue for public services and infrastructure. The OECD/G20 BEPS project represents a significant step towards a more equitable international tax landscape, but its success depends on the commitment and cooperation of countries worldwide. By continuing to refine and implement BEPS measures, the global community can work towards a fairer and more sustainable economic future.

Frequently Asked Questions (FAQs)

What is the full form of BEPS?

BEPS full form is Base Erosion and Profit Shifting.

What is the full form of OECD?

OECD full form is Organisation for Economic Cooperation and Development.