Business Cycle, also known as Economic Cycle or Trade Cycle, gives a crucial insight into the fluctuating levels of economic activities and growth in an economy. By depicting the periods of expansion and contraction in economic activities, they provide critical inputs to policymakers, businesses, and investors for decision-making. This article of NEXT IAS aims to study in detail the Business Cycle (Economic Cycle or Trade Cycle), its meaning, and different phases such as Recession, Depression, Recovery & Boom, along with various types of economic recovery.

Meaning of Business Cycle or Economic Cycle

- A Business Cycle is also known as Economic Cycle or Trade Cycle.

- It refers to various stages of rise and fall in the economy and reflects the fluctuations in economic activity that an economy undergoes over a long period.

“The business cycle is the periodic but irregular up-and-down movements in economic activity measured by fluctuations in real GDP and other macroeconomic variables. It is not a regular, predictable, or repeating phenomenon like the swing of the pendulum of a clock. Its timing is random and, to a large degree, unpredictable”. —Parkin and Bade

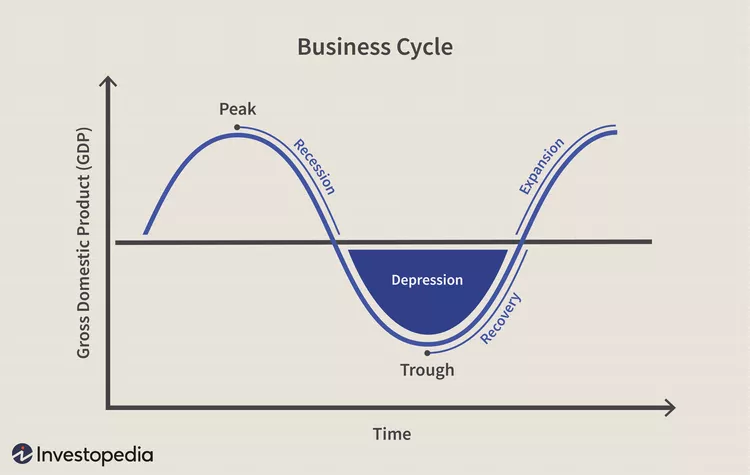

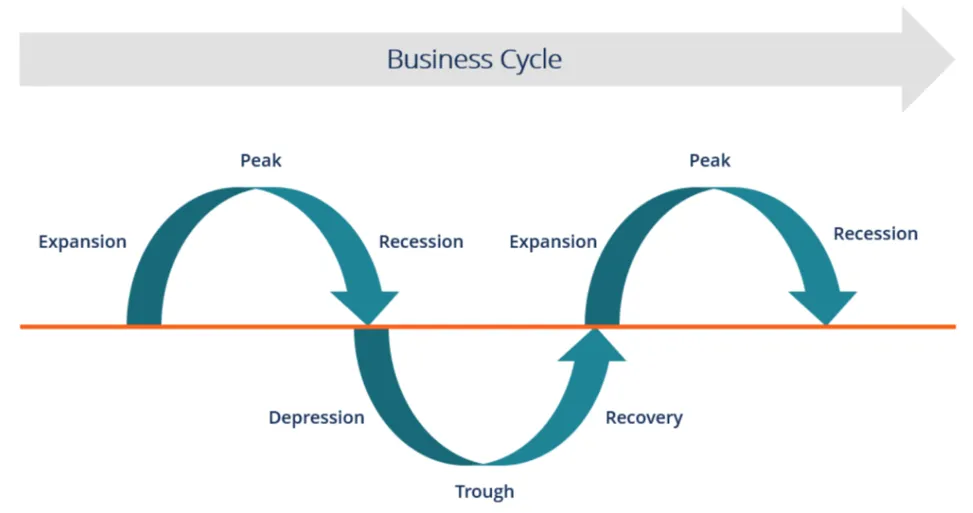

Phases of Business Cycle

- Economic activities in an economy are characterized by expansion in one period and contraction in the subsequent period. These fluctuations in economic activities are termed Business Cycle Phases or Economic Cycle Phases.

- Business Cycle Phases are also called Business Cycle Stages.

- The different Phases or stages of Economic Cycle represent the different levels of economic activities in terms of production, investment, employment, etc.

- The RBI releases the monthly RBI Bulletin, which provides the current statistics and state of the economy.

- Based on this, the growth or downfall of the economy and the current phase of Economic Cycle can be analyzed.

- Different Business Cycle Phases or Economic Cycle Phases are described in detail below.

Peak

- The ‘Peak Stage’ of the Business Cycle is the situation when all the economic indicators are at their peak stage of growth.

- At this stage, prices hit their highest level after which the economy stops growing.

- Thus, the economy is said to peak out.

Recession

- Recession is a slowdown or a massive contraction in economic activities.

- In other words, when the economy starts to contract, it is called the phase of the Recession.

- In this stage, there is a slowdown in production and low growth in sales and income.

- Accordingly, economic indicators such as GDP, corporate profits, employment, etc., fall during the Recession.

Technical Recession

When the Indian economy faces a downfall for two consecutive quarters and this results in the decreased GDP of the country, it is said to be a state of Technical Recession.

Depression

- Depression refers to a severe and prolonged recession that lasts three or more years or leads to a decline in real Gross Domestic Product (GDP) of at least 10% in a given year.

- A depression results in a severe and prolonged downturn in economic activity and is marked by low business and consumer confidence.

- The Great Depression of 1929 is considered to be the most classic example of a depression in economic history.

Trough

- A trough, in economic terms, refers to a stage in the business cycle where economic activities are bottoming, or where prices are bottoming, before a rise.

- In other words, Trough is the end of the depression stage, leading to the path of recovery.

Recovery

- Economic recovery is the phase of the business cycle, which comes following a recession and is characterized by a sustained period of improving business activity.

- Thus, Recovery can be said as the stage of a turnaround of the economy.

- Normally, during an economic recovery, Gross Domestic Product (GDP) grows, incomes rise, and unemployment falls as the economy rebounds.

- The prices are low due to the earlier phase of the Depression. The low prices generally lead to an increase in demand for goods, augmenting production, and hence leading to a revival in industrial production.

- Also, the Government takes various measures to boost demand and production in the economy with the help of fiscal and monetary policies which helps the economy to recover.

Expansion

- Expansion is the first stage in a new business cycle.

- A phase of expansion reflects an increase in income, employment, production, and sales.

Boom

- Boom refers to a period of increased commercial activity within either a business, market, industry, or economy as a whole.

- A period of Boom for an economy is marked by significant GDP growth.

- Recovery is the pre-condition for an economy to enter into this stage of the Economic cycle.

Cyclicity of Business Cycle

Under the Boom phase, an economy enters into the zone of high growth rate which is usually characterized by a high level of demand, high investment, greater lending by the financial institution, employment opportunity, increasing rate of inflation, high national income, high standard of living, etc.

During this phase, the existing capacity of plants is over-utilized. Unsustainable levels of lending and investment put pressure on both the financial institutions and the business firms. Labor and raw material shortages start to develop.

Ultimately, scarcity of resources leads to rising costs. This ultimately slows down the economic expansion and paves the way for contraction. Thus, the whole cycle repeats once again.

Relation between Inflation and Business Cycle

There’s a complex relationship between the business cycle and inflation. Usually, during economic expansions, demand for goods and services rises. Accordingly, businesses ramp up their production to meet the increased demand, which, in turn, leads to increased inflation.

On the other hand, during economic contractions, economic activity slows down. This can lead to lower demand for goods and services and hence reduced inflation.

However, it is to be noted that the relationship between the two isn’t always perfectly linear. Other factors, like government policies and global events, can also influence inflation rates.

Types of Shapes of Economic Recovery

- Economies don’t always bounce back from recessions in the same way. The path to recovery can take different shapes or forms.

- Different types of Shapes of Economic Recovery are depicted using alphabetic letters that resemble the graph of economic growth rate.

- Some prominent examples of Shapes of Economic Recovery are – Z-shaped Recovery, V-shaped Recovery, U-shaped Recovery, W-shaped Recovery, and L-shaped Recovery.

- All these Shapes of Economic Recovery are discussed in detail in the sections that follow.

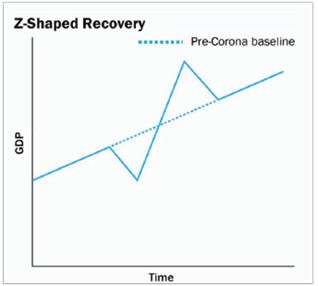

Z-shaped Recovery

- It is the most optimistic scenario in which the economy quickly rises after an economic crash.

- It makes up more than for lost ground before settling back to the normal trend line, thus forming a Z-shaped chart.

- In this economic disruption lasts for a small period wherein more than people’s incomes, it is their ability to spend is restricted.

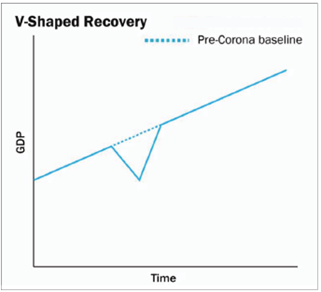

V-Shaped Recovery

- It is the next-best scenario after a Z-shaped recovery in which the economy quickly recoups lost ground and gets back to the normal growth trend line.

- In this, incomes and jobs are not permanently lost, and the economic growth recovers sharply and returns to the path it was following before the disruption.

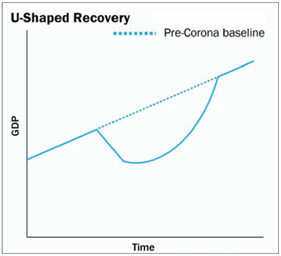

U-shaped Recovery

- It is a scenario in which the economy, after falling, struggles around a low growth rate for some time, before rising gradually to usual levels.

- In this case, several jobs are lost and people fall upon their savings.

- If this process is more long then it is called the “Elongated U-shaped Recovery”.

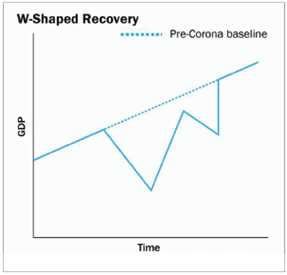

W-shaped Recovery

- In a W-shaped Recovery, growth falls and rises, but falls again before recovering, thus forming a W-like chart.

- The double dip depicted by a W-shaped recovery can be due to several reasons such as a second wave of the pandemic.

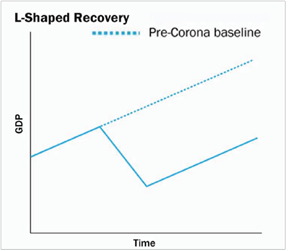

L-shaped Recovery

- In this, the economy fails to regain the level of GDP even after years go by.

- The shape shows that there is a permanent loss to the economy’s ability to produce.

Conclusion

The Business Cycle or Economic Cycle or Trade Cycle is an essential concept in understanding economic dynamics. Recognizing its phases and indicators helps in making informed decisions and planning for future economic conditions. While the cycle involves inevitable fluctuations, strategic responses can mitigate negative impacts and leverage opportunities during different phases.

GS - 3