Carbon Credit, Carbon Offsetting, Carbon Trading, and Carbon Tax have emerged as prominent tools to reduce greenhouse gas emissions. They are increasingly becoming popular mechanisms in the fight against climate change. This article aims to study various aspects of the concepts of Carbon Credit, Carbon Offsetting, Carbon Trading & Carbon Tax.

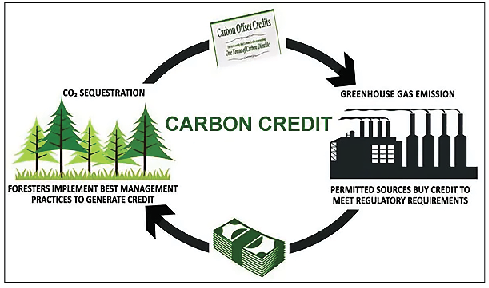

What is Carbon Credit?

- A Carbon Credit is a permit that allows a country or organisation to produce a certain amount of carbon emissions. If the full allowance is not used, the credit can be traded.

- It is a financial instrument that allows the holder to emit one ton of carbon dioxide or the mass of another greenhouse gas with a carbon dioxide equivalent to one ton of carbon dioxide (tCO2e).

- Carbon Credit is an attempt to reduce the growth in concentrations of GHGs.

- Carbon credits can be obtained through afforestation, renewable energy, Carbon sequestration, methane capture, and buying from a trading exchange for carbon credits.

Characteristics of Carbon Credit

When this concept was first discussed in the Kyoto Protocol, stakeholders noticed its benefits in sustaining life, saving the environment, and reducing carbon emissions. This list highlights some of the main characteristics of carbon credits:

- Individual Benefits: Domestic users can also gain by trading in carbon credits, which can help them adopt a more concerted and disciplined approach to reducing their carbon footprints.

- Buying Greenhouse Gases: According to most sources, purchasing carbon credits remains a lucrative enterprise.

- Each carbon credit purchased is channelled to a company specifically tasked with reducing emissions or providing more sustainable and environmentally friendly alternatives to these emitters.

- Business and Job Opportunities: Trading in carbon credits using the capitalist principle, if applied fairly, allows private investors to generate profits from their purchases and diversify their investments towards creating environmentally sustainable businesses that either emit very low or no carbons.

- As new businesses are started up, more employment opportunities arise.

Types of Carbon Credit

- Carbon credits come in several types, each serving distinct purposes to reduce greenhouse gas emissions.

- The most common are compliance credits, which are generated under government-mandated cap-and-trade systems. These systems allow companies to buy and sell emissions allowances to meet regulatory targets.

- Another type is voluntary carbon credits, created by projects that reduce or sequester carbon independently of regulations. These credits are often sold to businesses and individuals seeking to offset their own emissions.

- There are also forestry credits, which focus on preserving or expanding forests, and renewable energy credits (RECs), linked to generating energy from renewable sources.

Carbon Credits in India

- India is one of the largest sellers of Carbon Credits in the world thanks to the lower per capita emission in India.

- India is the second largest provider of Carbon credit projects under the Kyoto Protocol in the world.

- India has about a 10% share of the Global Carbon trading market.

- In India, Carbon trading is done through the Multi Commodity Exchange (MCX), the first exchange in Asia.

- According to recent reports, the carbon credit price in India typically ranges from ₹300 to ₹600 per tonne, depending on various factors like market demand, project type, and certification standards.

- The Indian carbon market is growing, driven by increasing corporate sustainability commitments and government initiatives to reduce emissions.

- Prices can fluctuate significantly based on regulatory developments and global market trends.

What is Carbon Trading?

- Carbon trading is the exchange of emission permits within a country’s economy or internationally.

- Every traded Carbon credit gives the country or a company the right to emit one ton of CO2.

- These credits can be traded for monetary and diplomatic gains by the countries.

- Countries emitting more carbon have fewer carbon credits, and countries with fewer emissions can purchase the right to emit more from a country with fewer emissions, as they have more carbon credits.

- Carbon credits are traded at various exchanges across the world. In India, they are traded through MCX.

Characteristics of Carbon Trading

The three key characteristics of carbon trading are as follows:

- Cap-and-Trade System: Carbon trading operates within a regulatory framework that sets a limit (cap) on the total amount of greenhouse gases emitted by certain industries or sectors.

- Companies are allotted emission permits, which they can trade with others if they emit less or more than their allotted amount.

- Market-Based Mechanism: Carbon trading creates a market for carbon allowances or credits, enabling companies to buy and sell them.

- Firms that reduce emissions below their allocated quota can sell excess credits, while those exceeding their limit must purchase more credits to comply with regulations.

- Incentive for Emission Reduction: The system encourages businesses to adopt cleaner technologies and reduce their carbon footprint.

- The financial cost of purchasing additional carbon credits or the potential revenue from selling unused allowances creates an economic incentive to reduce emissions.

Types of Carbon Trading

The types of carbon trading are as follows:

- Emission Trading or ’Cap-and-Trade’: Emission trading allows countries with spare carbon credits to sell this excess capacity to countries above their targets. The spare credits are emissions permitted but not utilised by the country.

- Offset Trading, Carbon Project Trading, or ‘Baseline-and Credit’ Trading: A country can earn carbon credit by investing in carbon projects. These projects will emit a lesser amount of greenhouse gases into the atmosphere.

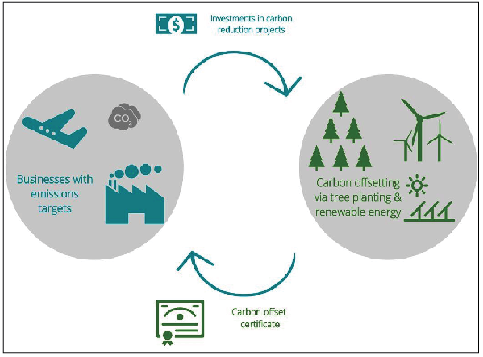

What is Carbon Offsetting?

- The term “Carbon Offsetting” was first coined in the Kyoto Protocol.

- Carbon offset schemes allow individuals and companies to reduce their emissions of carbon dioxide or greenhouse gases by investing in environmental projects worldwide.

- Companies and individuals balance out their carbon footprints.

- A carbon footprint is the total emissions of greenhouse gases by an individual or an organisation. It is expressed as carbon dioxide equivalent (CO2e).

- Carbon offsetting is the fastest way to achieve real emissions reductions and carbon neutrality.

- Carbon offsetting one ton of carbon means there will be one less ton of carbon dioxide in the atmosphere than there would have been.

- Carbon offsets are simple, immediate and cost-effective. They have a high impact and deliver verified emissions reductions in the actual sense.

Characteristics of Carbon Offsetting

The three key characteristics of carbon trading are as follows:

- Emission Reduction: Carbon offsetting allows individuals or companies to compensate for their greenhouse gas emissions by investing in projects that reduce or capture an equivalent amount of carbon dioxide elsewhere, such as reforestation or renewable energy initiatives.

- Measurable and Verifiable: Projects involved in carbon offsetting must provide measurable and verifiable emission reductions, ensuring the offset aligns with recognised standards and has a genuine impact on reducing global emissions.

- Voluntary or Compliance-Based: Carbon offsets can be purchased voluntarily by organisations seeking to reduce their carbon footprint or to meet regulatory requirements under emissions trading schemes.

Trade in Carbon Offsets

The carbon offset market is of two types:

Compliance Market

- This market allows Governments, Companies, and individuals to buy carbon offsets to comply with the allowed emission caps. It is a very large market.

Voluntary Market

- This market allows Governments, Companies, or individuals to buy carbon offsets to mitigate their own greenhouse gas emissions from services like transportation and electricity use.

- Purely voluntary offset buyers are driven by various corporate social responsibility, ethics, and reputational or supply chain risk considerations.

Benefits of Carbon Offsetting for Businesses

Carbon offsets give businesses a chance to:

- To differentiate yourself from less responsible competitors,

- To take a step towards carbon neutrality,

- To demonstrate courage and leadership,

- To help in gaining benefits that are extended globally and locally for the carbon offsets,

- To create an atmosphere of emission reduction activities reducing your carbon footprint,

- To build climate-resilient supply chains and support growth, and

- To launch new products and services.

Essential Criteria for an Acceptable Carbon Offset

For a carbon offset to be acceptable, it must meet the essential criteria:

- There has to be proof that it is additional emission reduction could not be possible without carbon finance,

- The carbon offset, once used, will be removed from the carbon offset market,

- The emission reduction is permanent, as stated,

- Their carbon offset does not increase the emissions.

What is Carbon Tax?

- A carbon tax is a tax imposed on the burning of carbon-based fuels like oil, gas, and coal.

- It is based on the carbon content of fuels.

- A carbon tax is the core policy for deterring and eventually ending the use of fossil fuels.

- This use of fossil fuels has increased CO2 emissions and destroyed our climate.

- A carbon tax is a way to make users pay for the climate damage they cause by burning fossil fuels and releasing carbon dioxide into the atmosphere.

- The carbon tax is a form of pollution tax.

- It is paid upstream, i.e., at the point where fuels are extracted from the Earth.

- Carbon tax offers socio-economic benefits. It increases revenue without significantly changing the economy while simultaneously promoting climate change policy objectives.

Characteristics of Carbon Tax

The key features of the Carbon Tax are as follows:

- Price on Carbon Emissions: A carbon tax directly sets a price on carbon by imposing a fee on the carbon content of fossil fuels, encouraging businesses and individuals to reduce emissions.

- Revenue Generation: The tax generates government revenue, which can be used for environmental programs, subsidies for clean energy, or redistributed to the public.

- Predictable and Transparent: Since the tax sets a fixed price per ton of carbon, it provides a predictable and transparent cost structure for companies, allowing them to plan their emissions reductions accordingly.

India and Carbon Tax

- India is one of the countries most affected by climate change, and hence, it has proactively taken steps to mitigate its effects.

- One of the steps is implementing a Carbon tax in India.

- It has progressively increased the tax on coal from Rs50/ton in 2010 to Rs400/ton in 2016.

- This was done to deter the use of coal and promote renewable energy sources. This clean energy tax will help finance India`s National Clean Energy Fund (NCEF).

- However, India will challenge any unnecessary carbon taxes that developed countries impose on Indian imports at the WTO.

Conclusion

In conclusion, Carbon Credits, Offsets, Trading, and Taxes are vital tools in the fight against climate change. They offer mechanisms to reduce greenhouse gas emissions, incentivize cleaner practices, and foster a shift towards a low-carbon economy. By leveraging these approaches, businesses and governments can make meaningful strides in mitigating climate impact and advancing environmental sustainability.

Frequently Asked Questions (FAQs)

What is Carbon Credit?

A carbon credit permits the holder to emit one tonne of carbon dioxide or an equivalent amount of a different greenhouse gas. These credits can be traded in carbon markets to help companies meet their emission reduction targets.

What is Carbon Trading?

Carbon trading is the buying and selling of carbon credits between companies or countries to comply with emissions reduction targets. It enables entities that reduce emissions below their cap to sell excess credits to those who exceed their limits.

What is Carbon Offsetting?

Carbon offsetting involves compensating for greenhouse gas emissions by investing in projects that reduce or remove emissions elsewhere, such as reforestation or renewable energy projects. This allows individuals and organisations to achieve a net-zero impact.

What is Carbon Tax?

A carbon tax is a financial charge imposed on companies or individuals for emitting carbon dioxide to incentivise the reduction of greenhouse gas emissions. It encourages the adoption of cleaner technologies and practices.

What is Carbon Market?

A carbon market is a trading system where carbon credits are bought and sold. It allows entities to meet emissions reduction goals through market-based mechanisms. It includes both compliance markets regulated by governments and voluntary markets for non-regulated emissions.