Currency Convertibility is a vital aspect of a nation’s economic framework, determining the ease with which its currency can be exchanged for foreign currencies. This mechanism plays a crucial role in international trade, investment, and economic stability. This article aims to study in detail the concept of Currency Convertibility, including its components – Current Account Convertibility and Capital Account Convertibility, and other related concepts such as Internationalisation of Rupee.

What is Currency Convertibility?

- Currency convertibility means that a country’s currency can be freely exchanged for foreign currency at an exchange rate, which is determined by the market forces i.e. demand for and supply of the currency.

- For example, convertibility of Rupee means that those having foreign currency (e.g. US dollars, Pound Sterling etc.) can get them converted into rupees and vice-versa at the market determined rate of exchange.

Components of Currency Convertibility

It has two components:

- Current Account Convertibility

- Capital Account Convertibility

Current Account Convertibility

Current Account Convertibility refers to the degree of freedom to convert your rupees into other internationally accepted currencies and vice versa without any restrictions whenever payments are made.

Current Account Convertibility in India

- In India, Current Account is today fully convertible since August 19, 1994.

- Prior to this date, India had partial Current Account Convertibility.

- Accordingly, several provisions like remittances for service, education, basic travel, gift remittances, donation, and provisions of the Exchange Earners’ Foreign Currency Account (EEFCA) were relaxed.

- It means that the full amount of foreign exchange required for current purposes will be available at the official exchange rate, allowing for an unrestricted outflow of foreign exchange.

- India was required to comply with Article VIII of the IMF, which puts prohibition on any exchange restrictions on current international transactions.

- Notwithstanding the above, the government still retains many controls on current account, such as:

- Repatriation of export proceeds within six months;

- Caps on the amounts spent on the purchase of services abroad;

- Restrictions on the repatriation of interest on rupee debt;

- Dividend-balancing for FDI in some consumer goods industries;

- Restrictions on the repatriation of interest on NRI deposits;

- The rupee is not allowed to be officially used as international means of payment. Indian banks are not permitted to offer two – way quotes to NRIs or-non-resident banks.

Note: With the help of these controls, the governments can significantly alter the flow of foreign exchange and the exchange rate of rupee. Additionally, the RBI can influence the exchange rate through direct purchase and sale of foreign exchange in the market.

Capital Account Convertibility

- Capital Account Convertibility (CAC) refers to the degree of freedom to convert foreign financial assets into domestic financial assets and vice versa at market-determined exchange rate.

- Thus, it allows anyone to move freely from local currency into foreign currency and back.

- Capital Account Convertibility is usually introduced after a certain period of introducing the Current Account Convertibility.

- The most important effect of introducing the convertibility in capital account is that it encourages the inflow of the foreign capital, because under certain conditions, the foreign investors are enabled to repatriate their investments, wherever they want.

- But the risk is that it may accelerate the flight of the capital from the country if things are unfavourable.

- For example, an Indian can sell property here and take the Capital outside. India, at present, has partial convertibility in capital account.

Capital Account Convertibility in India

- Following the recommendations of the S.S. Tarapore Committee on Capital Account Convertibility (1997), India has been progressing towards full convertibility in this account, while taking necessary precautions.

- India still maintains partial convertibility (40:60) in the capital account.

- However, within this policy framework, significant reforms have been implemented, and for certain levels of foreign exchange requirements, the economy allows full convertibility in capital account.

Steps taken for Capital Account Convertibility in India

The Government of India has taken the following steps towards capital account convertibility.

- Indian corporates are allowed full capital account convertibility for upto $ 500 million overseas ventures through automatic route.

- Indian corporates are allowed to prepay their External Commercial Borrowings (ECBs) of amount above $ 500 millions via automatic route.

- Individuals are allowed to invest in foreign shares, and other assets up to $ 2,50,000 per annum.

- Unlimited amount of gold is allowed to be imported (this is equal to allowing full convertibility in the capital account via current account route, but not feasible for everybody) which is not allowed now.

- The priority has been to liberalise inflows relative to outflows, but all outflows associated with inflows have been made completely free of restrictions.

- Among the type of inflows, FDI is preferred for its stability, while short-term external debt is avoided.

- A differentiation is made between individuals, banks and corporates.

Advantages of Capital Account Convertibility

- Improved access to international financial markets, thus leading to availability of large funds.

- Reduction in cost of capital.

- Incentivises Indians to acquire and hold international securities and assets.

- Greater financial competitiveness.

- Will help Indian corporations to use External commercial borrowing routes without RBI or Govt approval.

- Indian residents can hold and transact foreign currency-denominated deposits with Indian banks.

- Allowing access to the global financial market for certain class of financial institutions.

- Financial institutions such as banks can trade in Gold globally and issue loans.

Disadvantages of Capital Account Convertibility

- Market determined exchange rates are usually higher than the officially fixed exchange rates. Thus, it can raise import prices and cause Cost-push inflation.

- Improper management of convertibility in Capital Account can cause currency depreciation and hence affect trade and capital flows.

- The advantages have been found to be short lived as per studies.

- Post-2008 crisis, the international financial institutions are skeptical about CAC.

- Speculative activities can lead to capital flight from the country. For example, the case of South East Asian economies during 1997-98.

- Imposing controls would become challenging in a globalized environment once convertibility in Capital Account is introduced.

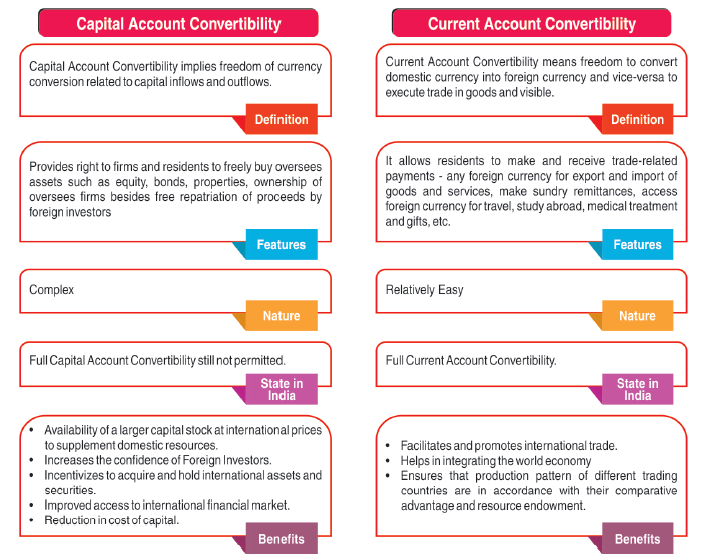

Capital Account Convertibility Vs Current Account Convertibility

Though Current Account Convertibility and Capital Account Convertibility both are components of Currency Convertibility, there are some differences between the two as depicted below:

Conclusion

Currency Convertibility, encompassing both current and capital account aspects, is crucial for integrating a country’s economy with the global financial system. While current account convertibility has been fully achieved in India, capital account convertibility remains a work in progress, balancing the benefits of increased financial access with the risks of economic instability. By carefully managing these components, countries can optimise their economic interactions on the international stage, fostering growth, competitiveness, and resilience in an interconnected world.

Internationalisation of Rupee

What is Internationalisation of Rupee?

- Internationalization of the Rupee refers to the process of increased cross-border transactions involving the Indian Rupees.

- It corresponds to trade, especially in import-export, capital account transactions and current account transactions.

- This would enable the settlement of international trade in Indian rupees, instead of a foreign currency such as US dollars.

- It aims to make it a more widely accepted and used currency in international trade and investment.

Benefits of Internationalisation of Rupee

- Mitigate exchange rate risk – It can reduce transaction costs of foreign trades and investments by mitigating the risks related to exchange rate fluctuations.

- Reduce risk – Eliminates the risk of exposure to currency volatility faced by Indian businesses.

- Exports becoming competitive – Reducing currency risk can reduce the cost of doing business and can hence help in making exports more competitive in the global market.

- Increased financial integration – Help to integrate the Indian financial system with the global financial system.

- This could lead to increased investment and economic growth.

- Reduced need for foreign exchange reserves – The need to maintain foreign exchange reserves can be reduced if a significant portion of India’s trade is settled in its domestic currency.

Challenges in Internationalisation of Rupee

- Complex Process – Rupee-trade arrangements is not easy to implement. For example, even after a year-long talks, the trade arrangements with Russia is not yet fully operational.

- Large trade deficit – With Russia would saddle Russia since with large rupee balances, it would have to find a way to use or invest.

- Small market – The Indian economy is not as large as some other economies, so there is less demand for the rupee in the global financial markets.

- Too much regulation – The Indian government has a number of controls on the rupee and these controls make it difficult for the rupee to be used as a global currency.

- Lack of liquidity – The Indian rupee is not as liquid as some other currencies, so it can be difficult to buy and sell large amounts of rupees.

Suggested Measures

- India should learn from China’s success in internationalising the renminbi (RMB), which also had a trade surplus across the world.

- Currency swap agreements and the creation of offshore markets could be explored and enhanced.

- Considerable thinking and planning would be required so as to ensure that it does not affect the economy’s fundamentals adversely.

- The settlements of foreign trades in rupees can be allowed.

- Creation of special rupee-denominated bonds can be explored.

- Steps should be taken to promote the use of Rupee in international payments.