Development Banks fill the critical gap in the Indian financial system by providing long-term finance to sectors that possess higher risks. As such, they played a pivotal role in shaping India’s economic landscape by promoting industrial growth, infrastructure development, and financial inclusion. This article of NEXT IAS aims to study in detail the Development Banks in India, including their meaning, types, roles, and significance.

What are Development Banks?

- Development Banks are also known as Term-Lending Institutions (TLIs) or Development Finance Institutions (DFIs).

- They are specialized financial institutions under the Banking System in India that provide long-term finance and support to the sectors of the Indian economy which possess higher risks and cannot have access to adequate loans from Commercial Banks.

| Note: Sources of Funds for Development Banks include – Share Capital of Owners, Issue of Debentures, and Provision of Capital by RBI, NABARD, Other Banks, and Central & State Governments. |

Difference between Commercial Banks and Development Banks

Both differ in their primary focus and operations. While Commercial Banks are primarily concerned with profit, Development Banks aim to promote economic and social development by providing financial resources for projects that might not otherwise secure financing from Commercial Banks due to their high risk, long gestation periods, or because they are not immediately profitable but have significant long-term benefits for the economy.

Objectives of Development Banks in India

Development banks in India have been established with several key objectives as can be seen below:

- Promoting Economic Growth: They are primarily aimed at fostering economic growth by financing long-term investments in key sectors like infrastructure, agriculture, and industry.

- Facilitating Infrastructure Development: They play a key role in financing the construction and development of essential infrastructure projects such as roads, bridges, power plants, and irrigation systems.

- Supporting Strategic Sectors: They also aim to support the development of strategic sectors that are critical for a nation’s economic well-being, such as renewable energy, transportation networks, etc.

- Encouraging Entrepreneurship and SMEs: By offering loans, equity investments, and advisory services, they help entrepreneurs and SMEs grow and create jobs.

- Balanced Regional Development: They strive to bridge regional disparities by directing investments towards underdeveloped or lagging regions.

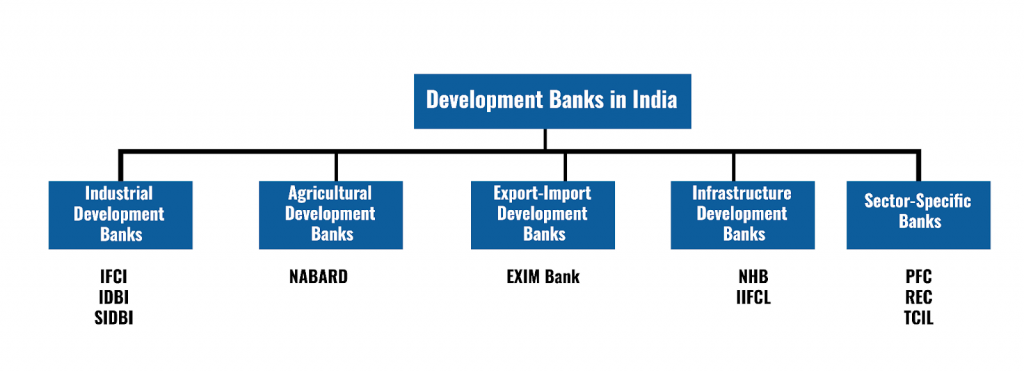

Types of Development Banks in India

Based on their primary function or sector of focus, they are of different types as described below:

Industrial Development Banks (IDBs)

- IDBs are specialized financial institutions under the Banking System in India that are established to promote industrial growth by offering financial assistance and support services to the industrial sector.

- Major IDBs operating under the Indian Banking System are:

Industrial Finance Corporation of India (IFCI)

- Industrial Finance Corporation of India (IFCI) Ltd. was set up in 1948 as a Statutory Corporation to provide medium and long-term finance to industry.

- The primary business of IFCI is to provide medium to long-term financial assistance to the manufacturing, services, and infrastructure sectors.

Industrial Development Bank of India (IDBI)

- The Industrial Development Bank of India (IDBI) was, initially, set up in 1964 as a subsidiary of the Reserve Bank of India (RBI) to provide credit and other financial facilities for the development of the Indian industry.

- At present, it’s a full-service commercial bank under the Banking System in India that supports industrial growth.

Small Industries Development Bank of India (SIDBI)

- Small Industries Development Bank of India (SIDBI) was set up in 1990 as an independent financial institution under the Banking System in India to aid the growth and development of Micro, Small and Medium Enterprises (MSMEs) in India.

- It acts as the principal financial institution for the promotion, financing, and development of the MSME sector in India, as well as for coordinating the functions of institutions engaged in similar activities.

Agricultural Development Banks (ADBs)

- ADBs are specialized financial institutions under the Banking System in India designed to support the agricultural sector by providing financial services and products tailored to the unique needs and challenges of agriculture.

- Major ADBs in India are:

National Bank for Agriculture and Rural Development (NABARD)

- National Bank for Agriculture and Rural Development (NABARD) was established on the recommendations of the B. Srivaraman Committee in 1982 with the primary responsibility of matters concerning policy, planning, and operations in the field of credit for agriculture and other economic activities in the rural areas of India.

- NABARD is the main agency for implementing the Rural Infrastructure Development Fund (RIDF) scheme. In this capacity, it performs the following roles:

- Serves as an apex financing agency for the institutions providing investment and production credit for promoting the various developmental activities in rural areas.

- Refinances the financial institutions that finance the rural sector, including State Cooperative Agriculture and Rural Development Banks (SCARDBs), State Cooperative Banks (SCBs), Regional Rural Banks (RRBs), Commercial Banks, and other financial institutions approved by the RBI.

- Supervises the Regional Rural Banks (RRBs).

Export – Import Development Banks

- They are specialized financial institutions under the Banking System in India, that facilitate and promote the country’s international trade by providing financial assistance to exporters and importers.

- Major Export-Import Banks in India are:

Export-Import Bank of India (EXIM Bank)

- Export-Import Bank (EXIM Bank) was set up in 1982 to take over the operations of the international financing wing of the IDBI.

- It provides Indian exporters with financial assistance, overseas investment credit, and technology and import finance, among other services.

Infrastructure Development Banks (IDBs)

- IDBs are financial institutions under the Banking System in India, dedicated to financing the development, construction, and improvement of a country’s infrastructure projects.

- Major IDBs under the Indian Banking System are:

National Housing Bank (NHB)

- National Housing Bank (NHB) is a state-owned bank and regulator that supports housing finance institutions and promotes housing finance schemes in India.

- NHB is regulated by the RBI.

India Infrastructure Finance Company Limited (IIFCL)

India Infrastructure Finance Company Limited (IIFCL) provides long-term finance to viable infrastructure projects in broad sectors of transportation, energy, water, sanitation, communication, and social and commercial infrastructure.

Sector-Specific Banks

- These are those Development Banks under the Banking System in India that are established to support specific sectors.

- Some examples of this category include:

Power Finance Corporation (PFC)

Power Finance Corporation (PFC) provides financial assistance to power sector projects.

Rural Electrification Corporation (REC)

Rural Electrification Corporation (REC) focuses on financing projects aimed at rural electrification.

Telecommunications Consultants India Ltd. (TCIL)

Although primarily a consultancy organization, Telecommunications Consultants India Ltd. (TCIL) also plays a role in financing telecommunications projects.

Roles of Development Banks in India

These banks play a multifaceted role in India’s economic landscape as can be seen as follows:

- Infrastructure Creation: Their long-term funding enables the development of critical infrastructure projects, laying the foundation for future economic activity.

- Empowering Businesses: They provide loans for capital investments, infrastructure development, and technological upgrades. This empowers businesses to grow and modernize.

- Promotional Activities: Much more than just simple lending activities, these banks offer advisory services, and partner with industry bodies to develop specific sectors.

- Promotion of SMEs: Institutions like SIDBI focus specifically on the SME sector, providing them with necessary financial services and support to help them grow and thrive.

- Export Promotion: The EXIM Bank provides financial assistance to exporters and importers, and helps in promoting cross-border trade.

- Social Development: By facilitating financing for rural and agricultural projects, they contribute to inclusive growth and poverty alleviation.

- Agricultural and Rural Development: NABARD plays a crucial role in financing agricultural and rural development, supporting a range of activities from irrigation infrastructure to microfinance institutions that lend to small farmers.

- Innovation and Technology Upgradation: These banks also fund research and development activities, facilitating the adoption of new technologies and innovations across various sectors.

Development Banks in India are central to the nation’s economic strategy, fostering industrial growth and socioeconomic development. By directing resources towards underserved sectors, they not only spur industrial growth but also contribute to regional balance and socio-economic development. As the country targets ambitious economic goals, the role of these banks will be more crucial than ever.

FAQs on Development Banks in India

Which was the First Development Bank of India?

The first development bank of India was the Industrial Finance Corporation of India (IFCI), established in 1948. It was created to address the medium- and long-term financial needs of the industrial sector in the country.

Is SBI a Development Bank?

No, SBI (State Bank of India) is not a development bank. It is a Scheduled Commercial Bank.