The International Monetary Fund (IMF) is a key institution in the global financial system. It plays a vital role in stabilising international monetary affairs and facilitating global economic growth. This article aims to study in detail the International Monetary Fund (IMF), its objectives, functions, governance structure, and other related concepts of IMF Quota, Special Drawing Rights (SDRs), and more.

What is International Monetary Fund (IMF)?

- The International Monetary Fund (IMF) is an international organisation of 189 countries, which works to secure financial stability, foster global monetary cooperation, facilitate international trade, promote sustainable growth and high employment, and reduce poverty across the world.

- International Monetary Fund formally came into existence on 27 December 1945.

- It is one of the Bretton Woods Institutions.

What are Bretton Woods Institutions?

| – The Bretton Woods institutions were established in 1944 at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. – After the Second World War, delegates from 43 countries met to help rebuild the shattered post-war economy and promote international economic cooperation, create a new international monetary system to ensure a foreign exchange rate system, prevent competitive devaluations, and promote economic growth. – One of the major outcomes of the Bretton Woods Agreement was the creation of the institutions like International Monetary Fund (IMF) and the World Bank (with its first group institution IBRD). – International Monetary Fund and World Bank, together, are popularly called as Bretton Woods Institutions or Bretton Woods Twins. – John Maynard Keynes was one of the founding fathers of the two institutes. |

Read our detailed article on the World Bank.

Objectives of International Monetary Fund

- To foster global monetary cooperation,

- To secure financial stability,

- To facilitate international trade,

- To promote high employment and sustainable economic growth, and

- To reduce poverty around the world.

Functions of International Monetary Fund

The fundamental mission of the International Monetary Fund is to ensure stability of the international monetary system. It performs the following functions:

- Surveillance: The International Monetary Fund oversees the international monetary system and monitors the economic and financial policies of its all 189 member countries.

- This process takes place both at the global level and in individual countries, which highlights possible risks to stability and advises on policy adjustments if needed.

- Lending: The core responsibility of the organization is to provide loans to member countries, which are experiencing actual or potential balance of payments problems.

- Unlike development banks, the International Monetary Fund does not lend for specific projects. Rather, it lends money to stabilize currencies, replenish international reserves, and strengthen conditions for economic growth.

- Capacity Development: It undertakes capacity development, and provides technical assistance and training to its members which helps them in designing and implementing economic policies that foster growth and stability by strengthening their institutional capacity and skills.

- Promote exchange rate stability and orderly exchange arrangement.

- It assists its members in the establishment of a multilateral payment system and the elimination of foreign exchange restrictions.

Governance Structure of IMF

- The International Monetary Fund is governed by and accountable to 189 member countries.

- Various components of its Governance Structure are explained in the sections that follow.

Board of Governors

- The Board of Governors (BOGs) is the topmost decision-making body of the organization.

- It consists of one governor along with one alternate governor from each member country.

- The governor is appointed by the member country, who is usually the Minister of Finance or the Governor of the Central Bank.

- The Union Finance Minister is the ex-officio Governor of India in the IMF and the RBI Governor is the alternative governor.

- All powers of the International Monetary Fund are vested in the Board of Governors, which performs the following functions:

- Approval of quota increases;

- Special drawing right allocations;

- The admittance of new members;

- Compulsory withdrawal of members etc.

- Amendments to the agreements a by-laws of the MOUs signed among nations.

- The Board of Governors normally meets once a year.

- Unlike the General Assembly of the United Nations, where each country has one vote, decision-making at the IMF has been designed in a way so as to reflect the relative positions of its member countries in the global economy.

Ministerial Committees

The Board of Governors is advised by two Ministerial Committees:

- International Monetary and Financial Committee (IMFC)

- Development Committee

International Monetary and Financial Committee (IMFC)

- The International Monetary and Financial Committee comprises 24 members selected from the 190 governors, and represent all member countries.

- It discusses and deliberates on the management of the international monetary and financial system.

- It also discusses proposals by the Executive Board to amend the Articles of Agreement.

- It can also discuss any other matters of common concern affecting the global economy.

Development Committee

- It is a joint committee, consisting of 25 members from the Board of Governors of the International Monetary Fund & World Bank.

- It main task is to advise the Boards of Governors of the International Monetary Fund and the World Bank on the issues related to economic development in developing countries and emerging markets.

- It serves as a forum for building inter-governmental consensus on critical development issues.

Executive Board

- The Executive Board of the International Monetary Fund comprises of 24 Executive Directors.

- The Executive Directors represent all the 189 member countries through a geographically based roster.

Managing Director

- The International Monetary Fund has a Managing Director (MD), who serves as the head of the staff and Chairperson of the Executive Board.

- The Managing Director (MD) is appointed by the Executive Board for a renewable five-years term.

- The employees of the organization come from across the world.

- They are responsible to the IMF, not to the authorities of their home countries.

IMF Quota System

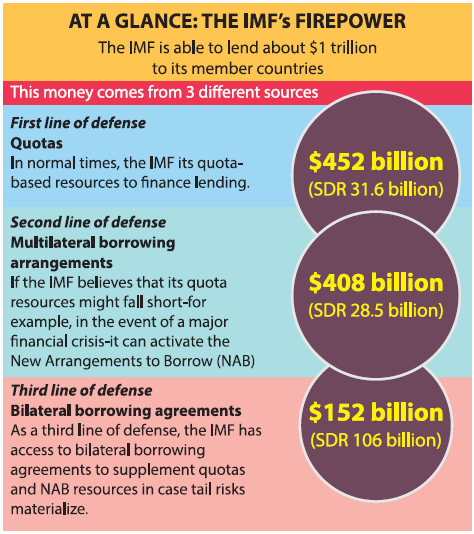

- The IMF’s quota system was created to raise funds for providing loans.

- Each member country is assigned a quota (i.e. contribution) that reflects the country’s relative size in the global economy.

- Higher quota is directly related to high voting rights and greater borrowing permissions.

- Quota defines the amount of assistance a country will get out of the contingency fund of the International Monetary Fund, as well as the power of a country to influence the lending decisions and tap into the funds themselves.

- Quotas are denominated in Special Drawing Rights (SDRs) – the IMF’s unit of account.

How IMF Quota is Determined?

- Upon joining the International Monetary Fund, each member country contributes a specified amount of money, known as a quota subscription.

- The quota subscription of a member country is determined according to the Quota Formula, which is based on the country’s economic performance and wealth.

- It is a weighted average of:

- GDP (weight of 50 percent),

- Openness (30 percent),

- Economic variability (15 percent),

- International reserves (5 percent).

Note: The GDP of a member country is measured through a blend of GDP based on market exchange rates (weight of 60 per cent) and GDP based on PPP exchange rates (40 per cent).

Significance of IMF’s Quota

A member’s quota plays several key roles w.r.t. the relationship between the International Monetary Fund and the concerned member, as described below.

- Subscriptions: The quota subscription of a member determines the maximum amount of financial resources that the member is obliged to pay to the organization.

- A member must pay its full subscription upon joining the International Monetary Fund.

- Up to 25 per cent of the quota must be paid in SDRs or foreign currencies acceptable to the organization, such as US Dollar, Japanese Yen, Euro, or British Pound Sterling, while the rest can be paid in the member’s domestic currency.

- Voting Power: Each member’s votes are comprised of basic votes plus one additional vote for every SDR 100,000 quota.

- Access to Financing: The amount of financing a member can obtain from the IMF (its access limit) is based on its quota.

- Under Stand-By and Extended Arrangements, a member country can borrow up to 145 per cent of its quota annually, and 435 per cent cumulatively.

Special Drawing Rights (SDRs)

- Special Drawing Rights (SDRs) is an international reserve asset, created by the International Monetary Fund in 1969, to supplement the member countries’ official foreign reserves.

- SDRs can be exchanged for freely usable currencies.

- The International Monetary Fund allocates SDRs to its member countries.

- A country’s quota, which represents the maximum financial resources it is required to contribute to the fund, determines its allocation of SDRs.

- Any new allocations must be voted on in the SDR Department of the organization and passed with an 85% majority.

- Initially, the value of the SDR was defined as equivalent to one US dollar.

- But, later its value was defined in terms of mutiple currencies.

- With effect from October 1, 2016, the SDR basket consists of the US Dollar, Euro, the Chinese Renminbi, Japanese Yen, and British Pound Sterling.

- The SDR also acts as the unit of account for the IMF

Major Reports Published by IMF

World Economic Outlook

- The International Monetary Fund publishes World Economic Outlook Report twice a year, which contains an analysis of global economic developments for the near and medium term.

- The report forecasts include key macroeconomic indicators, such as inflation, GDP, current account balance, and fiscal balance of more than 180 countries across the world.

- It also publishes the report on annual International Capital Markets.

Global Financial Stability Report

- It provides assessment of the global financial system and markets.

- It addresses emerging market financing in a global context.

Fiscal Monitor

- It was launched in 2009 to survey and analyse the latest public finance developments, update fiscal implications of the crisis and medium-term fiscal projections, and assess policies to put public finances on a sustainable footing.

- It is prepared twice a year by the Fiscal Affairs Department of the organization.

- It focuses on current market conditions and highlights systemic issues that could pose potential risks to the financial stability and sustained market access by emerging market borrowers.

India and International Monetary Fund

- India has been one of the largest recipients of funds from the International Monetary Fund.

- The Indian constituency countries include Bhutan, Bangladesh, and Sri Lanka.

- Presently, India holds 2.75% of the SDR quota and 2.63% of votes in the IMF.

- Though India has not been a frequent user of the organization, IMF credit has been instrumental in helping India in relevance to the Balance of Payments Crisis on multiple occasions, such as the post-partition crisis, Indo-Pakistan Conflicts of 1965 and 1971, in 1991-93, etc.

Need for Reforms in IMF

- Dominance of Developed Nations: The International Monetary Fund remains dominated by the developed nations, who guide most of its decisions in their own interests. Thus, the interests of other big economies like India & Russia are not addressed sufficiently.

- Conditionality: When providing loans to countries, the International Monetary Fund attaches conditions that require the implementation of specific economic policies. Though these conditionalities may help the countries economically, they are seen as an infringement on the right of political autonomy of the recipient country.

Reforms Taken by IMF in 2016

- The quotas for all 188 members were boosted, doubling the overall quota resources for the International Monetary Fund.

- Emerging and developing nation gained more influencing power in the governance planning of the International Monetary Fund. More than six per cent of the quota shares were transfer from the U.S. and European countries to developing and emerging nations. The reform gives emerging economies such as Brazil and China larger quota shares at the institution.

- India’s voting rights increased to 2.6% from the current 2.3% and China’s voting rights increased to 6% from 3.8%. China has the 3rd largest quota and voting share after the US and Japan. While, India, Russia and Brazil are among the top 10 members of the organization.

- About 6 per cent of quota shares will shift to emerging market countries. As a result, quota shares of the developed and traditionally strong economies such as the USA and European countries will be diminished. The quota shares of the poorest member countries will largely remain the same.

- The permanent capital resource of the International Monetary Fund has been doubled to SDR 477 billion (about US$659 billion).

- Executive Directors will now be appointed by elections, unlike earlier.

- IMF’s Executive body now consists of entirely elected Executive Directors, thus bringing an end to the category of appointed Executive Directors which is appointed by the five largest quota-holders.

- The reforms approved by the IMF’s Executive Board aim to ensure that the Fund can adaptively support the financing needs of Low-Income Countries (LICs) during the pandemic and recovery, while continuing to offer concessional loans at zero interest rates.

- The centrepiece of the approved policy reforms is a 45 per cent increase in the normal limits on access to concessional financing, coupled with the elimination of hard limits on access for the poorest countries. These higher access limits will facilitate the provision of more concessional support to LICs with strong policies and a large balance of payment needs.

Suggested IMF Reforms

The developing nations, including India, have been demanding the following reforms in the International Monetary Fund:

- Restructuring the voting rights/powers in the International Monetary Fund reflecting the current global economic scenario. This would require increasing the role of emerging nations like India and China while reducing the role of developed nations.

- Comprehensive review of the different conditionality associated with the IMF loans.

- More resources to IMF since the magnitude of international trade has increased and the number of countries that will approach to the International Monetary Fund (IMF).

- The current arrangement, which mandates the head of the IMF to be a European and the head of the World Bank to be an American, should be done away with.

- Long-term Crisis management rather than just short-term solutions advocated by the International Monetary Fund (IMF).

Conclusion

The International Monetary Fund (IMF) has a crucial role in maintaining global financial stability and promoting economic growth. As the world faces complex economic challenges, the IMF’s role in promoting stability, growth, and international cooperation remains ever more important. Necessary reforms should be made in the institution in order to make it more efficient and relevant to the current world economic order.

IMF Vs World Bank

| Attributes | International Monetary Fund (IMF) | World Bank (WB) |

|---|---|---|

| Ownership and Governance | By appointees of member countries. | By appointees of member nations. |

| Main Objective | Broadening and Strengthening the economies of member nations. | Broadening and Strengthening the economies of member nations. |

| Headquarter | Washington D.C. | Washington D.C. |

| Function | Exchange rate stability, provide financial resources to solve the problem of balance of payment, and promote international Monetary cooperation. | Promote economic and social progress in developing and poorer countries by helping to raise productivity and providing loans at a very concessional rate. |

| Assistance | Only to the government of the member nations. | Both to the government and private sector of the member nation. |

| Association and Size | IMF has no associated institutes and hence has a smaller staff. | It consists of five institutes associated with it and therefore has a larger size comparatively than the IMF. |

| Source of Funding | It is more like a credit union wherein members have access to a common pool of resources and these resources come from quota subscriptions and contributions from each member according to the size of its economy. | A kind of Investment fund where it borrows from one and lends to the other. It also borrows money by selling notes and bonds directly to their member nation’s government, their agencies, and central banks which they lend to other poorer and developing countries. |

| Recipient of Funding | Both the wealthy as well as poor nations experience a shortage of foreign exchanges or are facing a Balance of Payments Crisis. | Only to the developing and poorer nations and at a very minimal interest rate. It lends to even the private sector where it feels that assisting them would help improve the living conditions of the people. |