Syllabus: GS3/Economy

Context

- Goods and Services Tax (GST) has completed seven years of implementation.

About

- The government is now aiming to slowly move towards discussions on rationalise rates, from a current four-tier structure, probably, to a three-tier slabs.

- Another area can be the ceasing of the compensation cess, the cess was introduced for five years, to help states tide over the initial revenue loss and for the system to stabilise so that as revenues grow.

- States are back in financial health and this five-year period was to provide the cushion for the financial comfort.

Goods and Services Tax

- The GST was introduced in 2017 by the 101st Constitutional Amendment Act, 2016 as a comprehensive indirect tax for the entire country.

- It is a destination based tax on consumption of goods and services.

- It is levied at all stages right from manufacture up to final consumption.

- Only value addition will be taxed and burden of tax is to be borne by the final consumer.

- It accrues to the State or the Union Territory where the consumption takes place. It is of 3 types:

- Central GST (CGST): Levied by the Center.

- State/Union Territory GST (SGST/UTGST): Levied by States or UTs.

- Integrated GST (IGST): Tax levied and collected by the Center on all inter-state supplies of goods and/or services.

- The Center settles accounts with the States/UTs by transferring the SGST/UTGST portion of IGST to the destination state where goods/services were consumed.

- Four slabs for taxes for both goods and services: 5%, 12%, 18%, and 28%.

- Different tax slabs were introduced because daily necessities could not be subject to the same rate as luxury items.

- A cess is levied on the highest tax slab of 28% on luxury, sin and demerit goods.

- The collection from the cess goes to a separate corpus called Compensation fund. It is used to make up for revenue loss suffered by the state due to GST rollout.

- The GST Council is a constitutional body under Article 279A.

- It is a federal body comprising the Union Finance Minister as its Chairman and Finance Ministers of all States as members

- The GST Council members take almost all decisions on GST with consensus

- Exempted Items: The GST applies to all goods other than alcoholic liquor for human consumption and five petroleum products (common for the Center and the States): petroleum crude, motor spirit (petrol), high speed diesel, natural gas, aviation turbine fuel.

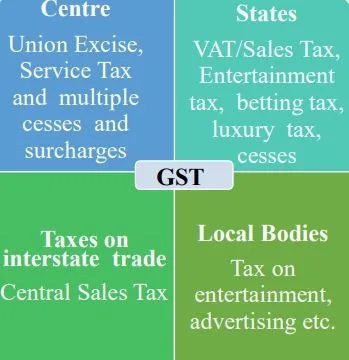

- The GST has replaced the following taxes which were used to be levied Government:

Need for the GST

- Elimination of Cascading Taxation: Prior to GST, the multiple layers of indirect taxes led to a cascading effect, where taxes were levied on taxes.

- GST simplifies this by allowing input tax credits, reducing the overall tax burden.

- Ease of Doing Business: A single tax regime reduces complexity, making it easier for businesses to operate across state lines, thereby promoting interstate trade.

- Broader Tax Base: GST aims to increase the tax base by bringing more businesses into the formal economy, which enhance revenue for both central and state governments.

- Reduction in Tax Evasion: The real-time tracking and electronic filing processes associated with GST help improve transparency and reduce the chances of tax evasion.

- Equitable Distribution of Revenue: GST aims to fairly distribute tax revenue between the central and state governments, ensuring that states receive adequate revenue based on consumption.

- Boost to the Economy: By simplifying tax structures and promoting compliance, GST is expected to contribute to overall economic growth and attract foreign investment.

- Digital Transformation: GST promotes the use of technology in tax administration, leading to more efficient governance and improved taxpayer services.

Challenges

- Complex Compliance: The multiple tax slabs and detailed compliance requirements are overwhelming, especially for small and medium enterprises (SMEs).

- Technology Dependence: The reliance on the GST Network (GSTN) for filing returns and managing compliance lead to issues, especially during peak times, causing delays and disruptions.

- Frequent Changes in Regulations: The dynamic nature of GST regulations and the frequent changes create uncertainty for businesses trying to stay compliant.

- Input Tax Credit Issues: Disputes often arise regarding the eligibility of input tax credits, leading to challenges in claiming credits for taxes paid on inputs.

- Anti-Profiteering Regulations: The provisions to ensure that benefits of tax reductions are passed on to consumers lead to complications and disputes for businesses.

Way Ahead

- Compensation Cess: In its recent meeting, the GST Council recommended the formation of a Group of Ministers to study the future of the compensation cess beyond March 31, 2026, and how the surplus balance under the GST compensation fund would be used.

- List of Exempted Items: So far, petroleum, oils, and lubricants (POL) products remain outside the GST net.

- One rationale for bringing them within the ambit of GST is to enable businesses to claim input tax credit on the same, which would help reduce costs and make them more competitive.

- Anti- Profiteering Cases: The Council decided to introduce a sunset clause for anti-profiteering cases, setting a termination date of April 1, 2025.

- This move is seen as a step towards streamlining the adjudication process, especially as the Competition Commission of India (CCI) has struggled with handling these cases due to a lack of expertise.

- The road ahead for GST, apart from reducing rates is also focused towards bringing in more simplification in the law, ease the compliances and, later on bringing in more and more taxpayers under the formal economy, so that the entire system runs on an auto-pilot mode.

Source: IE

Further Reading: 8 Years of GST

Previous article

Crackdown on Organized Crime

Next article

Concerns Related to Work-Life Balance