Syllabus: GS 2/Governance

In News

- Tamil Nadu Chief Minister M.K. Stalin called for increasing States’ share in the divisible pool of taxes to 50% to address financial burdens and ensure financial autonomy.

Highlighted Issues

- The current share of 33.16% falls short of the XV Finance Commission’s recommended 41%, blaming the Union government’s increased surcharges and cesses.

- The financial burden on States is exacerbated by their increasing share in Union-State joint projects and reduced devolution rates.

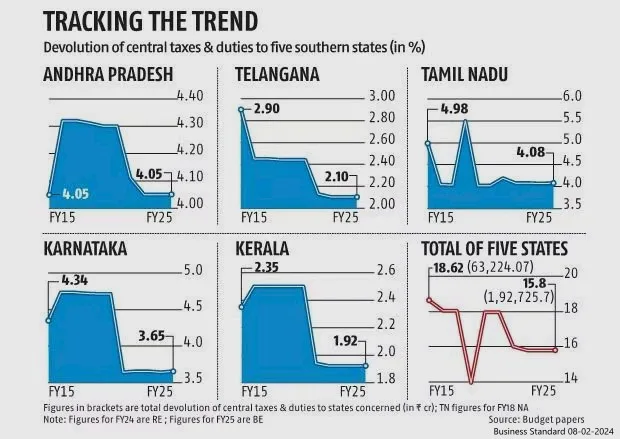

- Tamil Nadu’s share in the devolution pool has declined from 7.93% (IX Finance Commission) to 4.07% (XV Finance Commission), which is described as punitive for well-performing States.

What is a divisible pool of taxes?

- Divisible pool is the portion of gross tax revenue which is distributed between the Union and the states.

- Article 270 of the Constitution provides for the scheme of distribution of net tax proceeds collected by the Union government between the Centre and the States.

- The taxes that are shared between the Union and the States include corporation tax, personal income tax, Central GST, the Centre’s share of the Integrated Goods and Services Tax (IGST) etc.

- This division is based on the recommendation of the Finance Commission (FC) that is constituted every five years as per the terms of Article 280.

- Apart from the share of taxes, States are also provided grants-in-aid as per the recommendation of the FC.

- The divisible pool, however, does not include cess and surcharge that are levied by the Centre.

- The 16th Finance Commission of India, chaired by Dr. Arvind Panagariya, has been constituted to make recommendations for the fiscal period 2026-31.

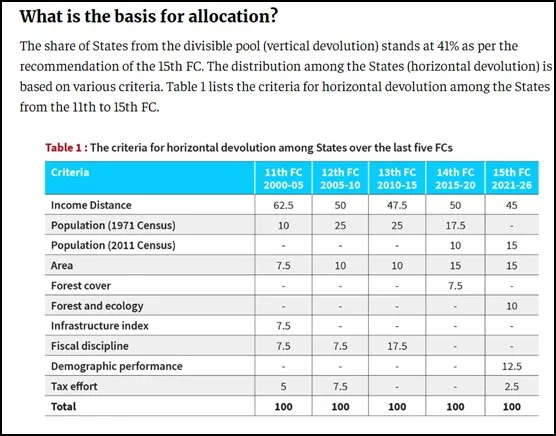

Allocation Mechanism

- Vertical Devolution: The 15th FC recommended 41% of the divisible pool for States.

- Horizontal Devolution: Based on criteria such as income distance, population (2011 Census), forest cover, demographic performance, and tax effort.

Key Issues

- Cess and Surcharge: Constitute 23% of the Union’s gross tax receipts but are excluded from the divisible pool, limiting States’ share to 32% of total tax revenue, below the 41% recommended.

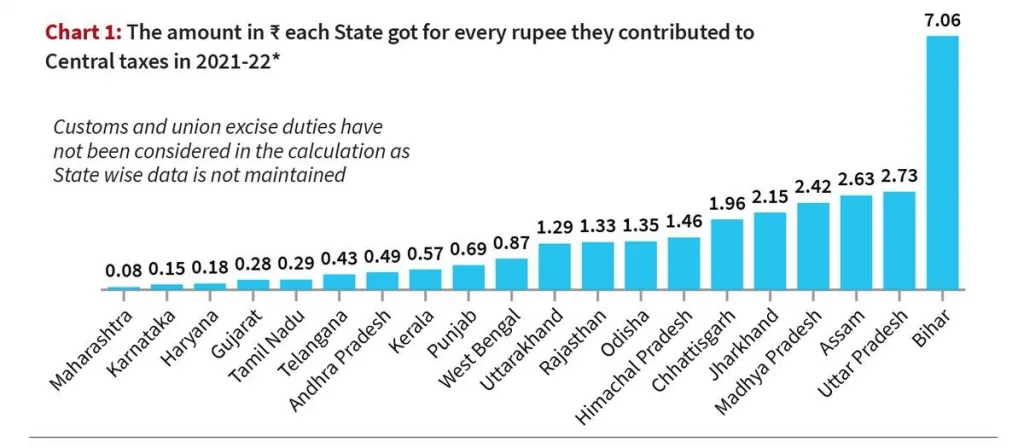

- Revenue Disparity: Industrial States receive less than a rupee for every rupee contributed to Central taxes, while less developed States like Uttar Pradesh and Bihar receive more.

- Southern States’ Decline: Southern States’ share in the divisible pool has been reducing over six FCs due to higher weightage for equity-based criteria (income gap, population, and area) over efficiency-based criteria (demographic performance and tax effort).

- Grants-in-Aid Variations: Grants provided for revenue deficit, sector-specific needs, and local bodies differ widely among States.

Proposed Reforms

- Include Cess and Surcharge: Expand the divisible pool by including a portion of cess and surcharge, and reduce their imposition over time.

- Increase Efficiency Weightage: Add relative GST contributions as a criterion and give more weight to efficiency in horizontal devolution.

- Enhance State Participation: Establish a formal mechanism for State involvement in the Finance Commission, similar to the GST Council.

- Strengthen Fiscal Federalism: Encourage States to allocate adequate resources to local bodies to promote equitable development.

Conclusion and Way Forward

- The underdeveloped States need support, over-allocating funds to them at the expense of developed States could harm overall national development.

- Balancing equity and federalism requires reforms in revenue sharing, ensuring States contribute to and benefit from national development while preserving their financial autonomy.

Source: TH

Previous article

News In Short 18-11-2024

Next article

Audit Diwas and Role of CAG