Syllabus: GS3/Agriculture

Context

- The Union Cabinet has approved the continuation of Pradhan Mantri Fasal Bima Yojana and Restructured Weather Based Crop Insurance Scheme till 2025-26.

About

- The Cabinet approved setting up of the Fund for Innovation and Technology (FIAT) for technology improvements in insurance schemes.

- Key initiatives include Yield Estimation System using Technology (YES-TECH), which uses remote sensing for crop yield estimates.

- Weather Information and Network Data System (WINDS) for augmenting weather data through automatic weather stations.

About Pradhan Mantri Fasal Bima Yojana

- Launch: In 2016 by the Ministry of Agriculture & Farmers welfare.

- Objectives: It is a crop insurance scheme that provides financial support to farmers in case of crop failure or damage due to natural calamities, pests, or diseases.

- to stabilize the income of farmers to ensure their continuance in farming;

- to encourage farmers to adopt innovative and modern agricultural practices;

- to ensure flow of credit to the agriculture sector.

- Coverage: All farmers including sharecroppers and tenant farmers growing the notified crops in the notified areas are eligible for coverage.

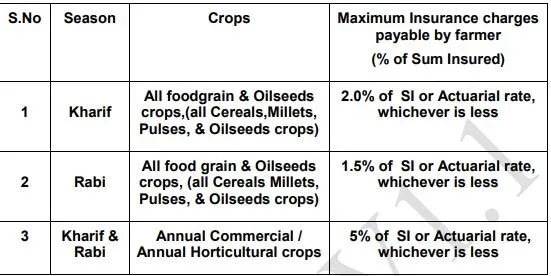

- Coverage of Crops: Food crops (Cereals, Millets & Pulses), Oilseeds and Annual Commercial / Horticultural crops.

- Share between Centre and State: As the States have a major role in implementation of the scheme the premium subsidy is shared by the Central and State Government on a 50 : 50 basis and for North-Eastern States sharing pattern has been made 90 : 10.

About Restructured Weather Based Crop Insurance Scheme (RWBCIS)

- It was launched in 2016 to mitigate the hardship of the insured farmers against the likelihood of financial loss on account of anticipated crop loss resulting from adverse weather conditions.

- While PMFBY is based on yield, RWBCIS uses weather parameters as “proxy‟ for crop yields in compensating the cultivators for deemed crop losses.

- All standard Claims are processed and paid within 45 days from the end of the risk period.

Agri Credit in India

- Sources of Agricultural Credit: Public sector banks (like the State Bank of India), regional rural banks (RRBs), cooperatives, and NABARD (National Bank for Agriculture and Rural Development) provide most formal agricultural credit.

- Types of Agricultural Credit:

- Short-term Credit: Used for financing working capital needs like seeds, fertilizers, and pesticides.

- Medium and Long-term Credit: Used for purchasing equipment, irrigation systems, and land development.

- Challenges:

- Low credit penetration in rural areas.

- Dependency on informal credit sources with high interest rates.

- Issues with loan recovery and defaults.

| Other Relevant Government Schemes – Kisan Credit Card (KCC) Scheme: Provides short-term credit to farmers for crop production and agricultural needs. Offers flexible repayment terms. – Pradhan Mantri Kisan Samman Nidhi (PM-KISAN): Direct income support of ₹6,000 per year to small and marginal farmers in three installments. – Interest Subvention Scheme: Subsidizes interest rates on crop loans up to ₹3 lakh, reducing financial burden on farmers. – Farmers’ Development Loans (FDL): Long-term loans for land development, irrigation, and purchasing farm equipment. – Rashtriya Krishi Vikas Yojana (RKVY): Provides funding to states for enhancing agricultural infrastructure and productivity. – National Mission on Agricultural Extension and Technology (NMAET): Enhances agricultural productivity by supporting extension services and technology adoption. – Credit Guarantee Fund Scheme (CGS): Offers credit guarantees to micro and small enterprises, including agri-businesses. – Rural Infrastructure Development Fund (RIDF): Provides loans for rural infrastructure projects like irrigation and soil conservation. – Kisan Rin Portal (KRP): This digital platform aims to revolutionize access to credit services under the Kisan Credit Card Scheme (KCC) by offering a comprehensive view of farmer data & loan disbursement specifics and fostering seamless integration with banks. |

Source: PIB

Next article

Incineration Process